VENDILIGENCE™

Financial Health Assessment

Our Financial Health Assessment (FHA) helps by providing you with a thorough review of your vendors' or suppliers' financial stability and resilience to identify risks and uncover potential vulnerabilities in their economic frameworks. Our experts' deep dive saves you time and effort and helps your business make informed choices pre-contract or when completing due diligence on your current third parties.

PRODUCT TOUR

See it in Action: Take a tour of the Financial Health Assessment

Outsourcing this crucial review to Venminder means obtaining a clear picture of your vendor's or supplier's financial stability and resilience. It goes beyond basic financial metrics, offering you a holistic perspective that includes compliance, financial trends, and detailed notes analysis to ensure a complete understanding of their financial position.

Most Commonly Used For:

Critical Financial Partners and Key Service Providers

Venminder is trusted by over 1,200 companies worldwide

Our deep dive review helps you gain insight into

your vendors' or suppliers' overall financial health

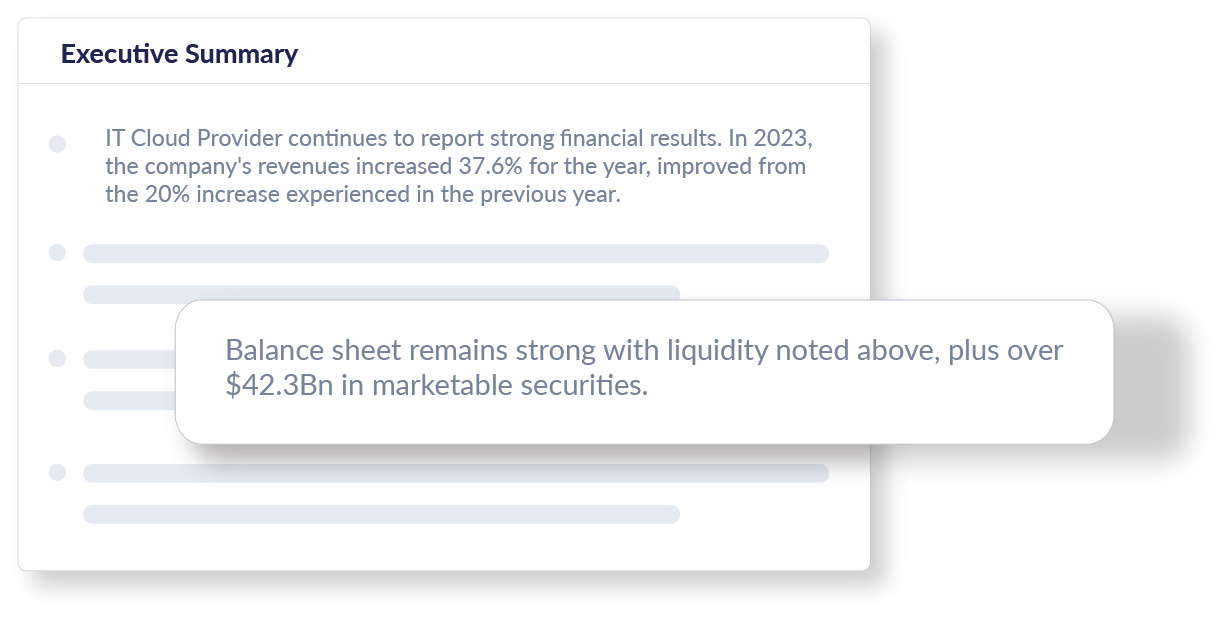

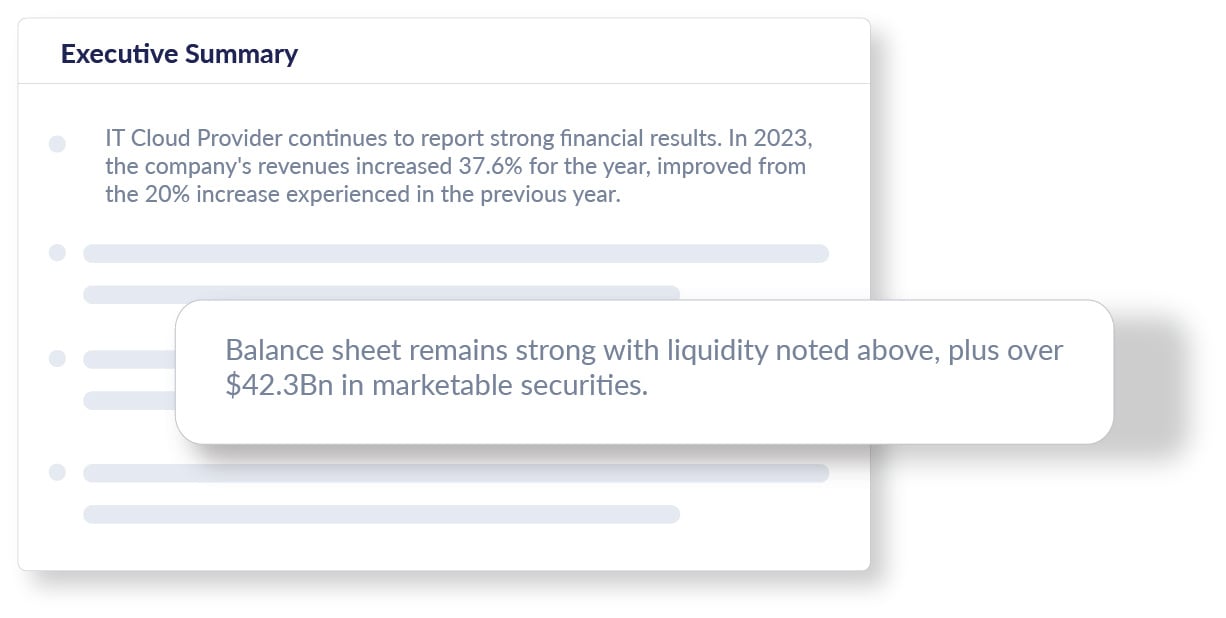

Executive Overview

Get a quick, insightful glimpse into a company's financial health. This detailed overview not only provides a snapshot of a company's financial stability and comprehensive financial health key points but also includes an in-depth expert review of notes and footnotes, along with bulleted tailor-made comments. It ensures you have a comprehensive understanding, enhancing your confidence for swift and informed decision-making. Perfect for those who value both depth and speed in financial assessments.

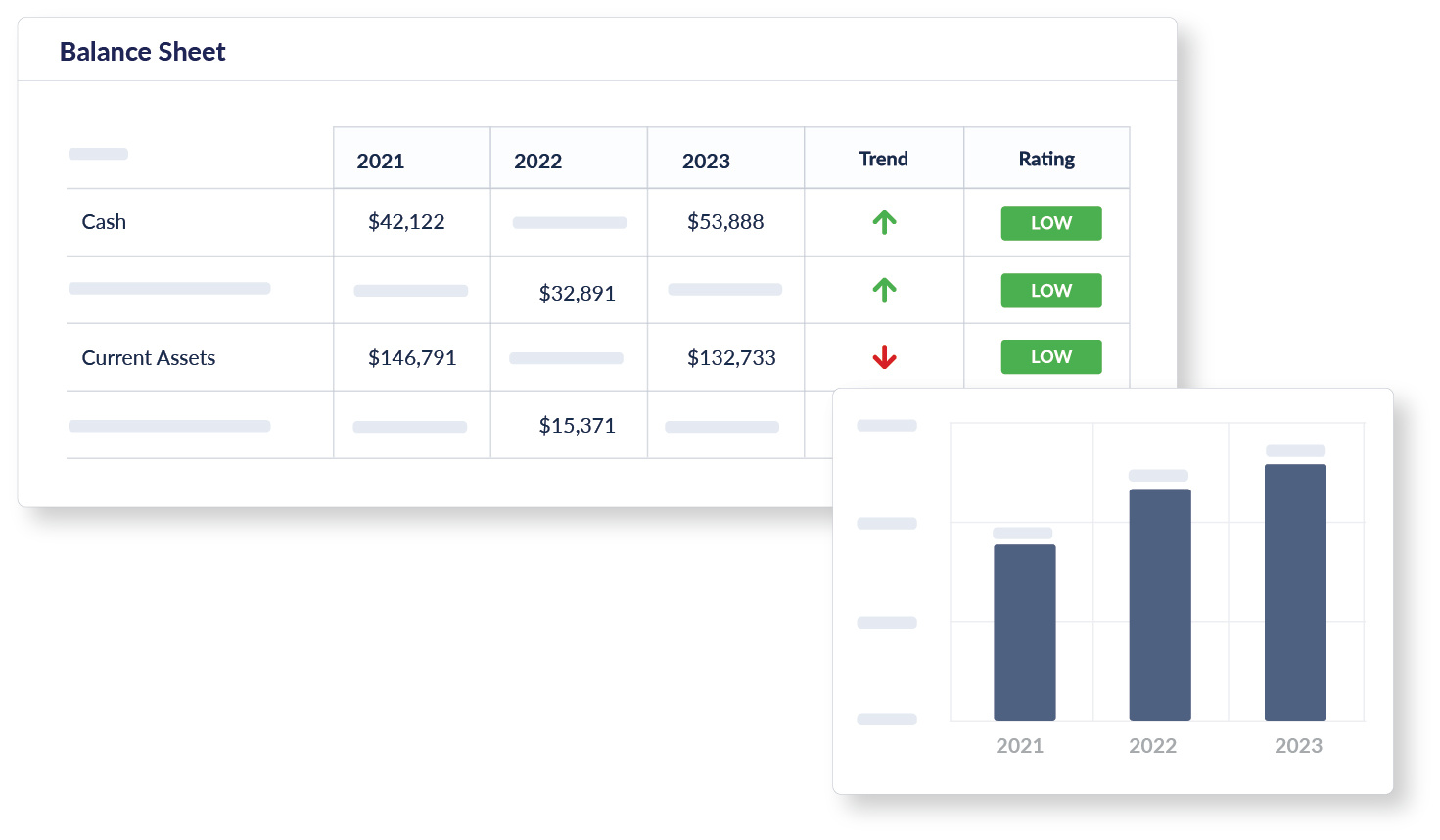

Balance Sheet

Within our Summary Data, the Balance Sheet overview provides a clear view of a company’s liquidity, efficiency, and overall stability. Understand the viability of cash reserves, the status of incoming payments, and the proportion of assets to liabilities, all essential indicators to gauge financial robustness. Beyond the numbers, it features straightforward trend indicators with easy-to-understand arrows, revealing the movement of financial metrics at a glance. Together with expert risk ratings, these visual trends provide a layered view of the company's financial journey.

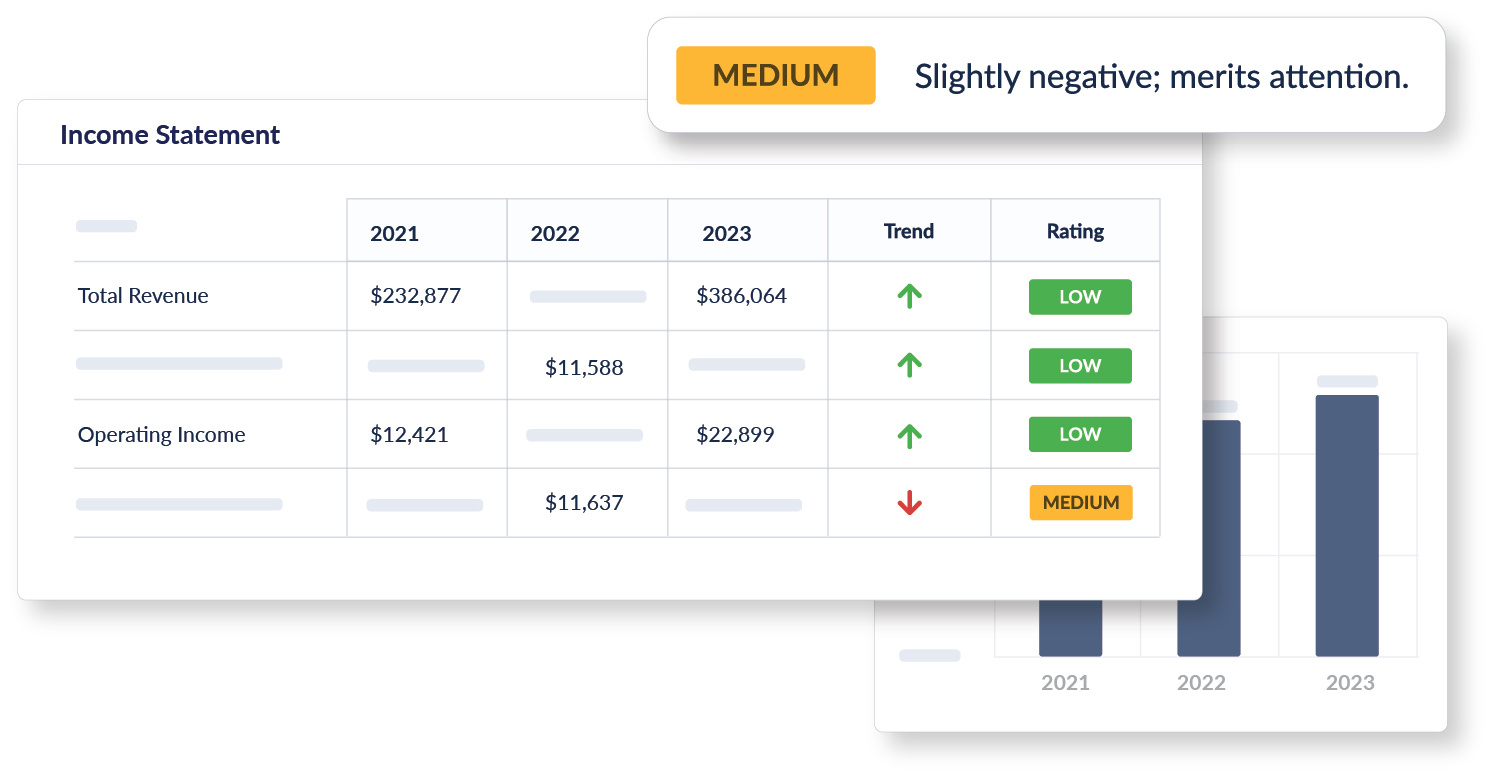

Income Statement

Our Income Statement overview distills the essence of a company's revenue-generating ability and fiscal efficiency. It shows the total revenue, signaling the company's market strength, while gross profit and margins offer a window into cost management and pricing strategies. Operating and net income figures cut to the heart of operational success, and comprehensive income provides a wider lens on the company's financial achievements. This, along with an easy-to-read chart comparing year-over-year data, allows you to effortlessly track progress and identify patterns.

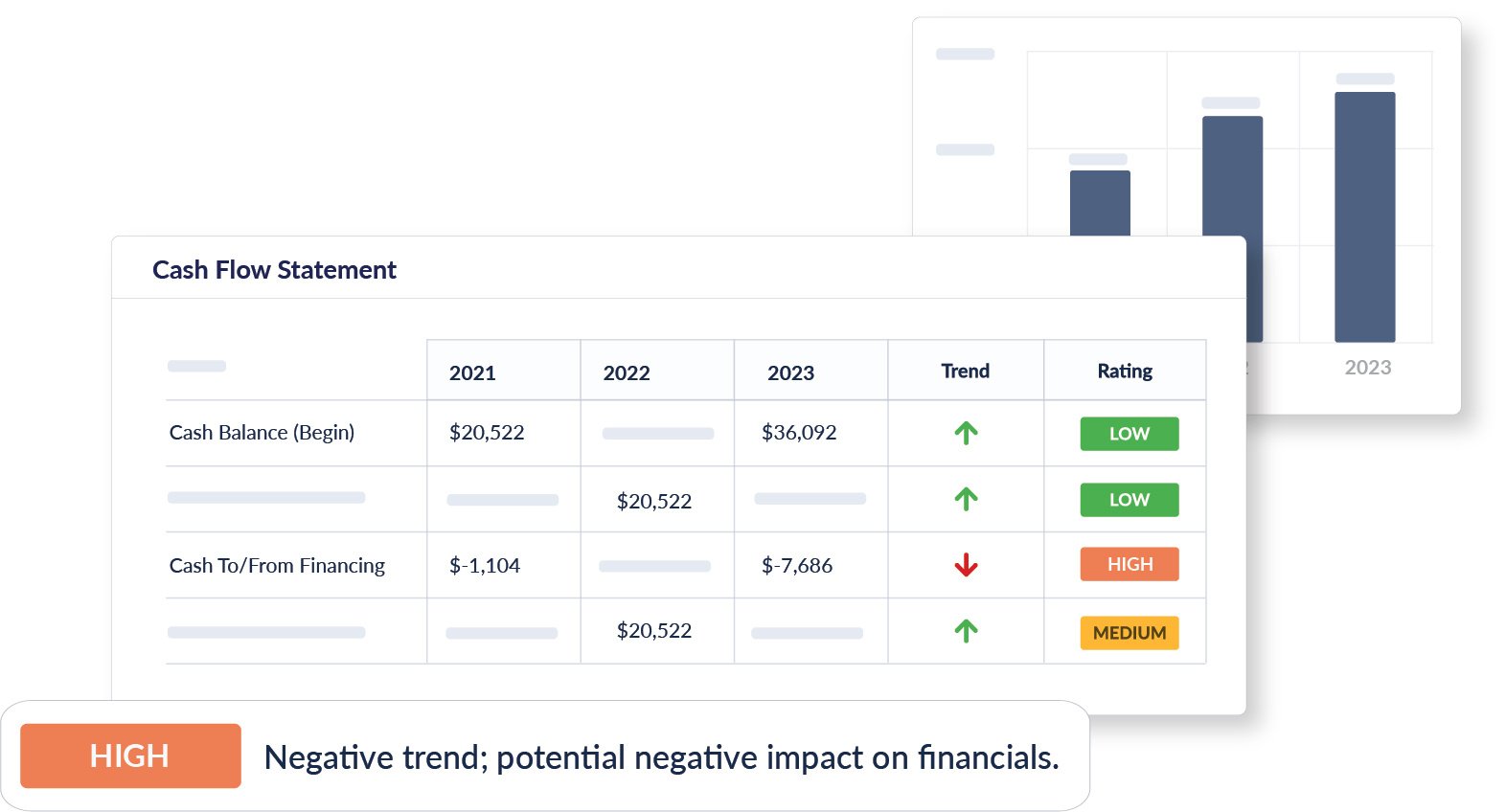

Cash Flow Statement

The Cash Flow Statement overview provides a clear view of a company's liquidity, tracking the flow of cash from operations, investments, and financing. It begins with the opening cash balance, moves through the cash generated or used in business activities, and concludes with the closing cash balance. This information is key to understanding a company's financial health, offering insights into the ability to fund operations, reinvest, and manage financial obligations. It's a straightforward measure of a company's financial stability over time.

Key Ratios

With a glance, gauge liquidity, evaluate the financial structure, and identify earnings quality. These key ratios swiftly show a company's financial agility with the current ratio, reveal leverage insights through Liabilities to Net Worth measures, and showcase profitability through net income margin. The Altman Z Score offers a predictive glance at a company's financial endurance. These ratios are not just numbers; they're the pulse of financial health, enabling you to make informed decisions backed by comprehensive data.

More than just number-crunching

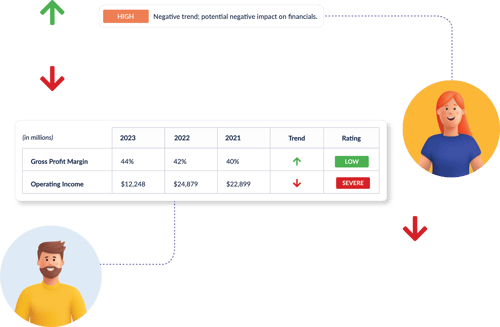

Expert Risk Ratings

Both overarching and focused risk ratings grant a layered understanding, enabling you to make decisions faster. Our assessment dives into processes your vendor has in place for business continuity testing, their business impact analysis, and backup management.

Actionable Comments and Recommendations

We provide a written, bulleted summary of findings, including a high-level recap of the vendor's financial situation. We summarize the main findings from the risk domain coverage of the assessment, to determine the overall financial health, offering clear and actionable insights.

Avoid Financial Instability in Supply chains

Economic ups and downs can make vendors unstable, causing problems in your supply chains. These issues might come from changes in the market, bad financial management, or sudden downturns. They can seriously disrupt your business. To handle these risks, you need to keep a close watch, understand financial trends, and have plans to lessen their effects. This task requires knowing how financial issues can affect your vendors and your supply chain's reliability.

Our financial health assessment actively checks and measures your vendor’s financial health. This helps spot and mitigate potential risks and problems in your supply chain before they happen. We look at many financial signs and trends across key quantitative and qualitative disclosures. This gives you a clear picture of how your vendors are doing financially. With this information, you can make smart choices and act early to keep your business running smoothly and effectively.

Easy Tracking of Financial Regulations

Financial information disclosures change a lot, making it hard to ensure your vendors provide adequate or sufficient information or compliant financial disclosures. If vendors do not provide or keep adequate and compliant financial information, it could lead to downstream risks on your organization, such as business disruption, fines, and even hinder your organization’s reputation. With global supply chains, vendors are subject to various financial disclosure and preparation standards worldwide. It’s crucial to have a strong system to keep track of vendor financial disclosures, checking if vendors are properly preparing, maintaining, and disclosing financial information. This allows for swift, informed adjustments in vendor relationships, helping protect your business from legal complications and keep you in good standing from a regulatory and compliance perspective.

With Venminder, the FHA makes it easier to make sure your vendors follow financial disclosure rules and proper information disclosures. We do a detailed check of whether or not vendors have audited financials, dig deep into the financial statements and disclosures, and traverse footnotes and management disclosures to identify any issues in the vendor’s financial disclosures. This helps your organization work with vendors that are in compliance with specific disclosure requirements and also keeps your organization’s reputation pristine and safer. Our vendor and supplier financial health assessment keeps you informed about a vendor’s financial information and disclosures to marry it with your internal and external regulatory and compliance requirements.

Standardized and Thorough Financial Checks by Experts

Doing a full financial check on vendors can be difficult because their financial reports are complex. You need to look deeper than just the numbers to understand the full financial picture, including the small details in their reports. These details are important for deciding on contracts and monitoring risks. This thorough check takes a lot of skill and time but is crucial for making smart decisions about your vendors.

Venminder's FHA offers an expert, in-depth look at financial due diligence. Our financial risk experts do more than just number-crunching; they dive into the details of financial reports and the notes. This gives you a deeper understanding of your vendor's financial health and risks. Our experts' deep dive saves you time and effort. It helps your business make informed choices about your vendors and manage risks better.

How it works

STEP 1

Alleviate the time spent chasing for financial statements

Venminder’s team directly works with your vendor or supplier to collect the financial statements and documents needed for a qualified and comprehensive financial health assessment.

STEP 2

Assessed by experienced professionals

Venminder’s experienced professionals include CPA's who thoroughly review the evidence to assess whether your vendor or supplier has implemented the industry standard and regulatory requirement processes that should be in place to avoid disruptions that could ripple into your business workflow.

STEP 3

Streamlined Financial Assessments

You receive an easy-to-understand risk assessment on your vendor or supplier's financial health that is available on the Venminder platform and as a downloadable PDF. Our reports are easy to understand and are perfect for internal sharing, review, and decision-making.

STEP 4

Improve risk-based decisions with the right insights

You and your organization’s decision-makers can now make an informed choice about any risks presented by the vendor or supplier and whether you need to take action in addressing potential gaps and take the necessary countermeasures.

Discover why Venminder

is top-rated by customers

Know if vendors and suppliers are in compliance with

industry guidelines, frameworks, standards and laws

Technology Standards and Frameworks

AICPA Trust Services Criteria

ISO/IEC 27001:2022

NIST Framework for Improving Critical Infrastructure Cybersecurity version 1.1

NIST SP 800-53 Rev. 5 Security and Privacy Controls for Information Systems and Organizations

NIST SP 800-63b Digital Identity Guidelines

Regulations, Statutes, and Laws

California Consumer Privacy Act

California Privacy Rights Act

Canadian Personal Information Protection and Electronic Documents Act

China Personal Information Protection Law

Colorado Privacy Act

Connecticut Data Privacy Act

EU General Data Protection Regulation

Health Insurance Portability and Accountability Act

Interagency Guidelines Establishing Information Security Standards

Interagency Guidance on Third-Party Relationships

New York Department of Financial Services - 23 NYCRR 500

Industry Guidance

Center for Internet Security – Critical Security Controls v8

FFIEC IT Examination Handbook – Audit Booklet

FFIEC IT Examination Handbook – Business Continuity Booklet

FFIEC IT Examination Handbook – Management Booklet

FFIEC IT Examination Handbook – Operations Booklet

FFIEC IT Examination Handbook – Outsourcing Technology Services

FFIEC IT Examination Handbook - Wholesale Payment Systems Booklet

FINRA Report on Cybersecurity Practices

OCC 2021-36 Authentication and Access to Financial Institution Services and Systems

SEC Regulation SCI reference to NIST 800-53 Rev. 4

Learn about the regulations, standards, guidelines, and laws, that our assessments map to here >

You won't just hear it from us

Free Sample

Financial Health Assessment

Get a sample copy of this risk assessment to see how Venminder can reduce your work and help you identify potential gaps at your vendor before they disrupt your business or your customers.

Free Resources

Ensure Your Third Parties can continue to Support you when faced with the Unexpected

Explore Venminder

Continuous Monitoring

Software Platform

Why Choose Venminder

Continue your Education

.gif?width=1920&name=Sample-Graphic-Animation%20(1).gif)