6 min read

Emerging Securities Risks: What Investment Advisers and Firms Need to Know in 2026

Do you know how many vendors your firm has? Do you know how your broker-dealers, custodians, and other service...

Browse and search through our free resources created by our in-house experts based on industry guidance and best practices to help you build and improve your third-party risk management program.

Investment advisors outsource to service providers to help run a more efficient practice. But what happens when a service provider harms your business? It’s more common than you think – and the costs of a vendor mistake can be shockingly high.

investement advisor, investments, outsourcing, advisor outsourcing

Understanding how to maximize your TPRM resources will take some effort, but it's a worthwhile goal to help your organization manage risk, regardless of limitations. This informative infographic covers how to maximize your resources.

maximize resources, tprm resources, manage resources, vendor management resources, tprm processes

Keeping your eye on any negative news or adverse media on a third-party vendor is necessary for any organization that wants to safeguard its reputation. Learn examples of adverse media, tips to monitor adverse media, and more.

negative news, reputation risk, vendor reputation, adverse media screening, screening news, safeguard your reputation

By monitoring vendor privacy scores as part of your vendor risk management program, you can mitigate potential risks associated with third parties more effectively. Download this infographic to learn what vendor privacy scores are and more.

privacy scoring, vendor privacy, vendor privacy scores, how to use privacy scores, manage vendor risk, risk mitigation

FINRA has increasingly focused on third-party risk management, outlining its expectations for broker-dealers to manage outsourcing risks. Learn how to comply with these expectations in this eBook

broker-dealer tprm requirements, tprm requirements for broker-dealers, broker-dealers

Financial health is a critical indicator of the vendor’s ability to deliver consistent quality and support when you need it most. That makes vendor financial health an important element to review during your vendor due diligence process. Learn more in the infographic.

poor financial health, poor vendor health, poor vendor financial health, financial health, vendor financial health, struggling vendor

As your vendor inventory grows, so do the challenges; limited resources, increase risk and inconsistent oversight. This infographic share practical tips to help you take control of your large vendor inventory.

vendor inventory, large vendor inventory, vendor inventories, managing vendor inventories, what is a vendor inventory

When outsourcing a product or service to a third-party vendor, your organization is exposed to risks that naturally occur, referred to as inherent risks. Learn sample questions to ask and next steps to take after completing a questionnaire in this eBook.

inherent risk, vendor risk, sample questionnaire, vendor risk assessment, eBook, questionnaire

Download this checklist to ensure your vendor's business continuity and disaster recovery plans are in place and on the right track.

checklist, vendor management, business continuity checklist, vendor business continuity, vendor disaster recover, disaster recovery checklist

What does your fintech company need to know about third-party risk management to meet client expectations and protect your business? Learn more in this infographic

tprm practices, fintech tprm, fintech best practices, best practices for tprm, fintech tprm practices

Do you have some questions about TPRM at your broker-dealer? Learn common questions and answers in this infographic.

small broker-dealers, broker-dealers

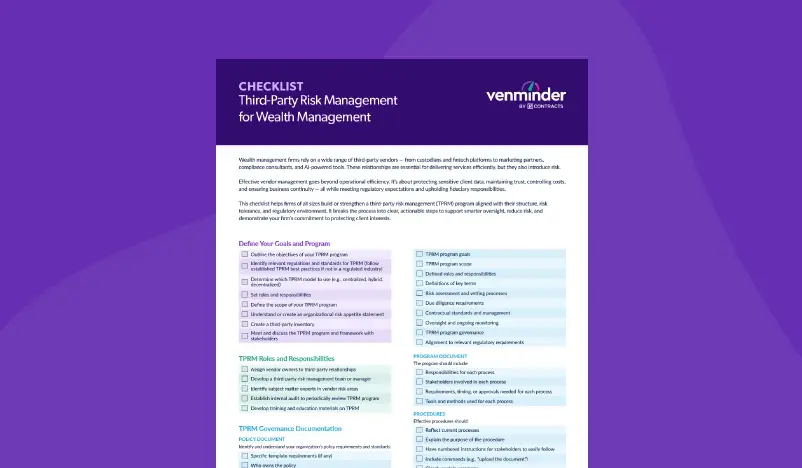

Use this checklist as guide for your wealth management firm to manage vendor relationships while maintaining compliance.

wealth management checklist, tprm checklist wealth management, third-party risk for wealth management

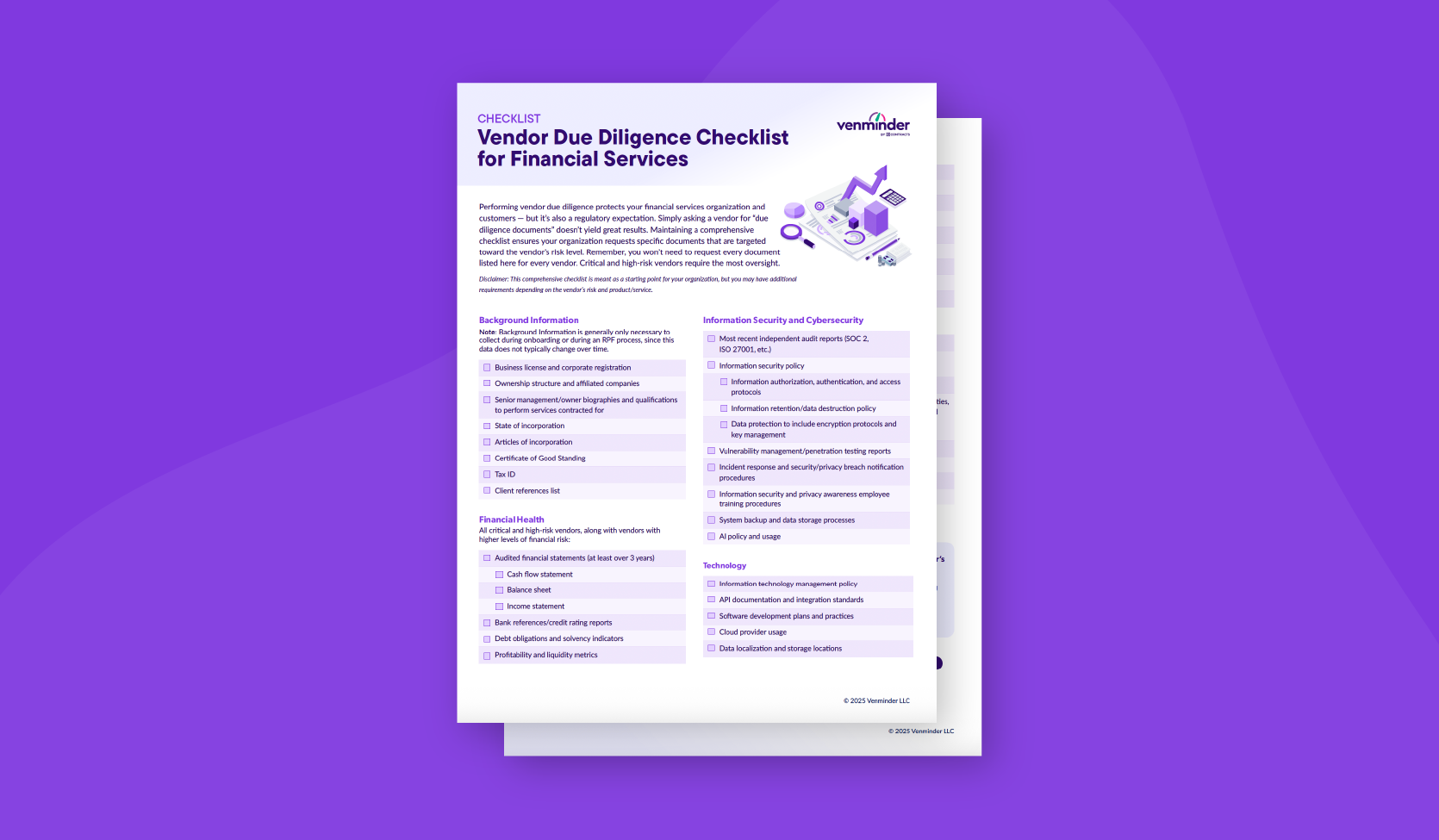

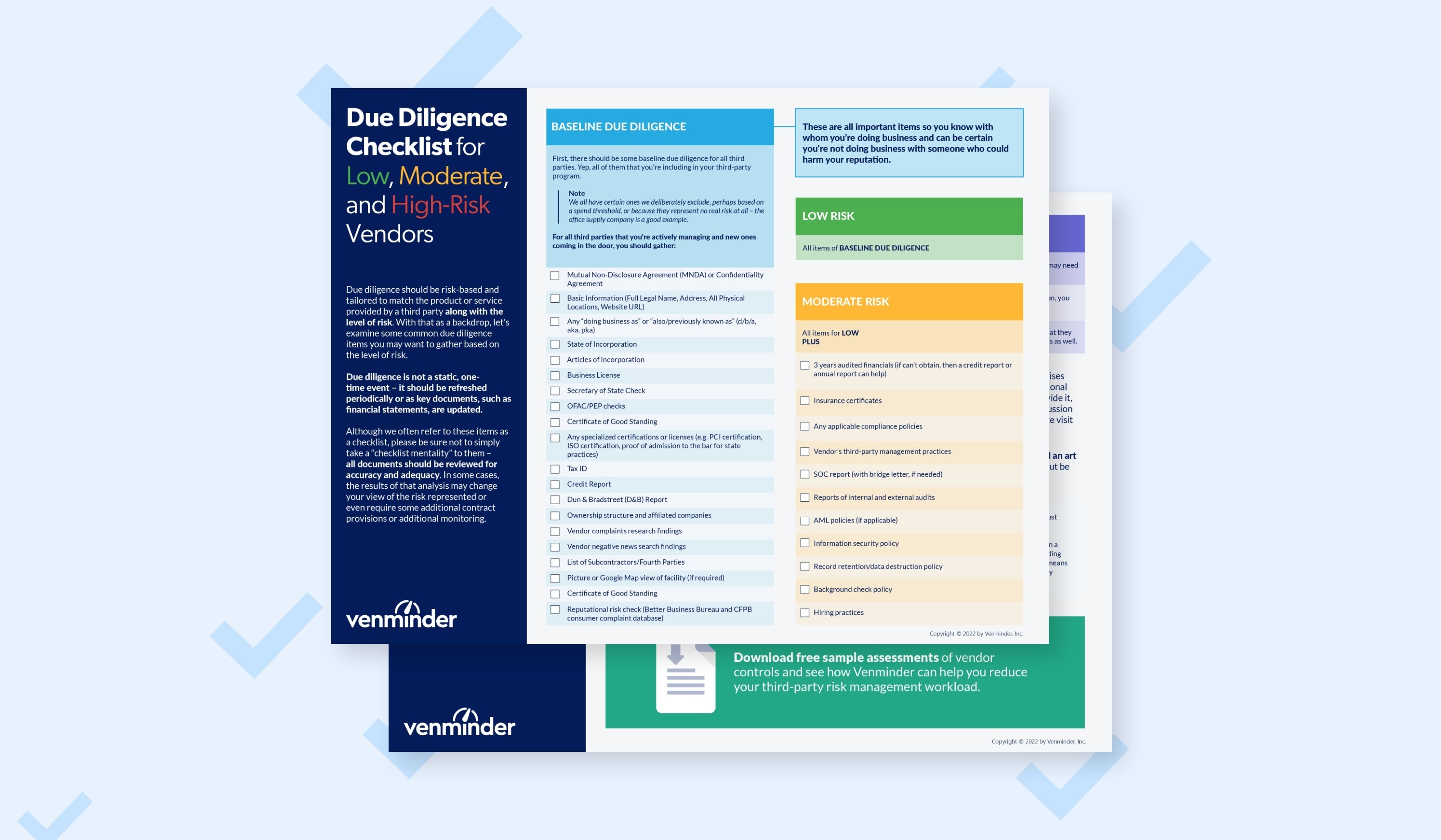

Maintaining a comprehensive checklist ensures you request specific documents that are targeted toward the vendor’s risk level. Use this checklist as a guide.

vendor financial services, financial services due diligence, due diligence for financial services, how to conduct due diligence on financial services

Venminder’s State of Third-Party Risk Management 2025 whitepaper provides third-party risk management insights and industry statistics to help you make informed programs decisions. Learn how others are managing third-party risk.

vendor management, vendor risk management, data, analyze, results, analysis

Allocating a dedicated TPRM budget isn’t just a necessity — it’s a smart investment. A well-funded TPRM program empowers organizations to proactively identify, assess, monitor, and mitigate third-party risks. Learn more in the infographic.

vendor management budget, TPRM budget, budget, vendor manager budget

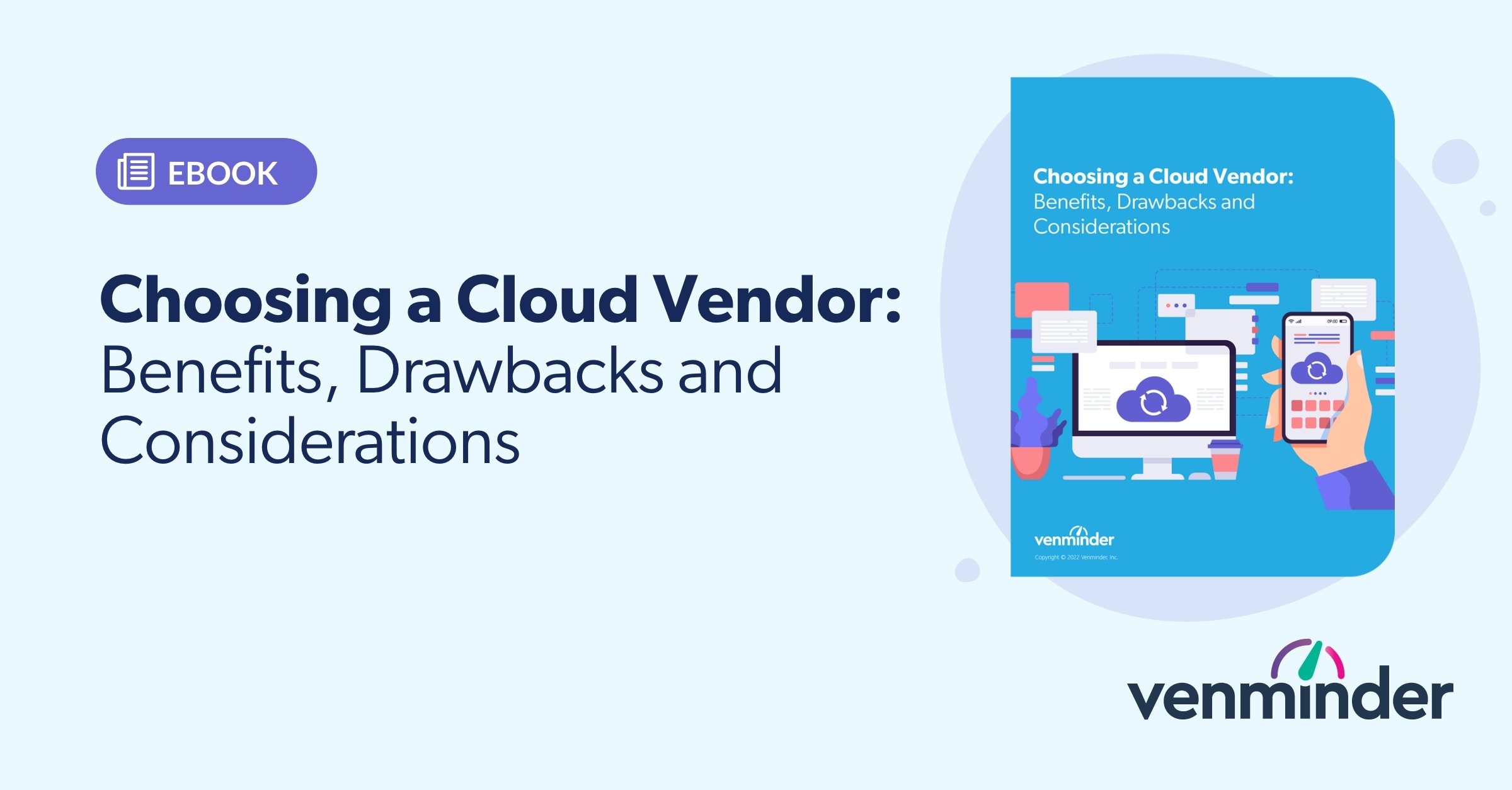

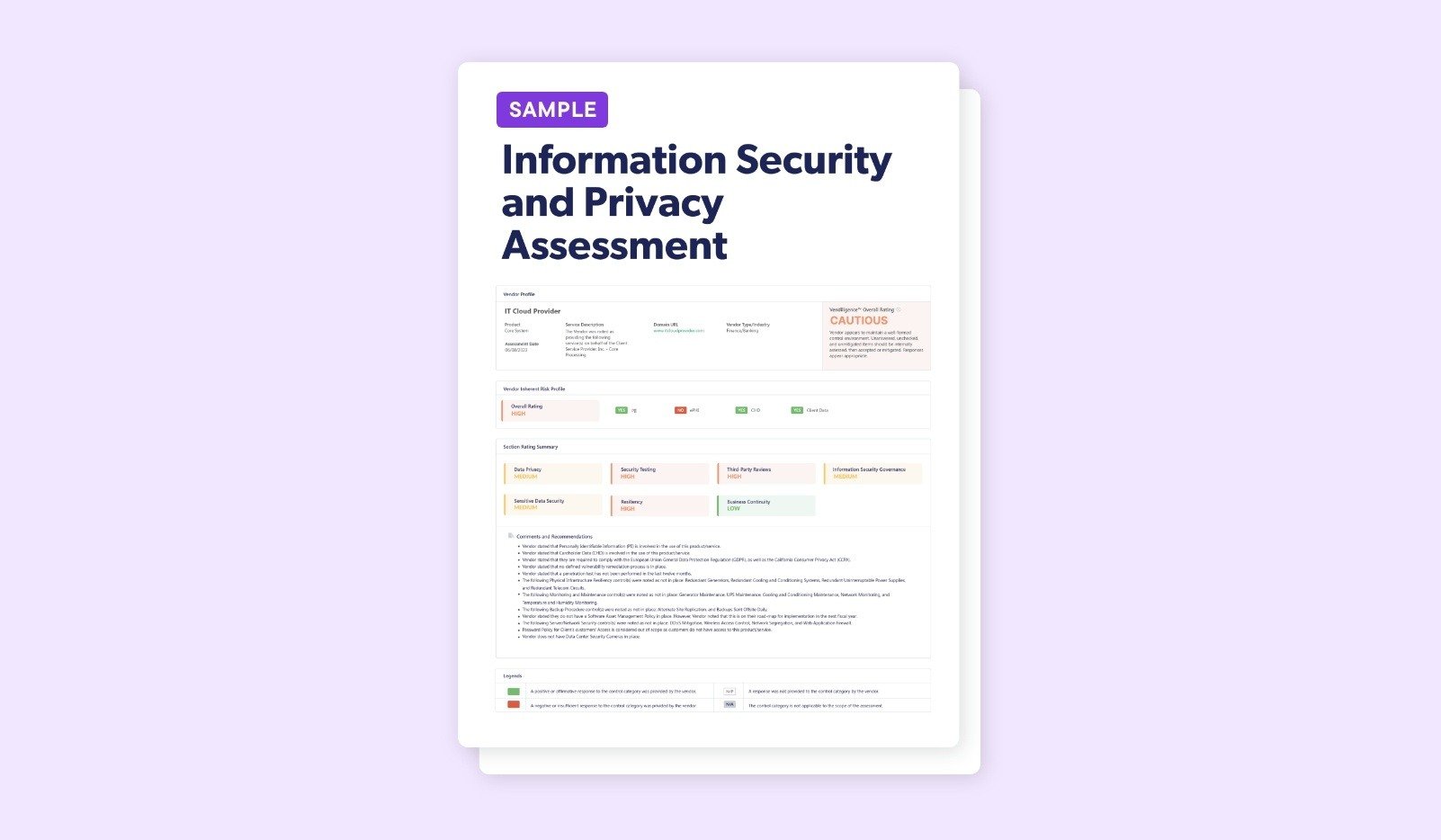

As many organizations have turned to cloud vendors to store sensitive information, it's more important than ever to review your cloud vendors. Learn how to in this eBook.

cloud vendor management, vendor risk, cloud vendors, cloud risk, assessing vendors

While there are many benefits of BaaS, these services come with risks on both sides of the partnerships. It’s crucial to identify and assess the associated risks and the measures banks and non-bank entities can take to manage them effectively.

banking as a service risk, banking as a service partnerships, banking as a service vendors, baas vendor partnerships, baas vendor relationship, banking as a service

To manage risks effectively, an organization's risk culture plays a crucial role. A risk culture refers to an organization's mindset and approach toward managing risks. Learn how to develop a third-party risk culture in this eBook.

risk culture, develop a culture, tprm culture, vendor risk culture, vendor management culture, developing risk cultures

Vendor risk management may seem like a large investment, but there's a significant ROI your organization can attain. Understand how a VRM program is a smart investment for your organization.

Whether you're new to the world of TPRM, or an experienced veteran, you've probably heard the term "vendor risk assessment". In the eBook, learn the process of vendor risk assessments and how to overcome challenges.

vendor risk assessment, third-party risk, third-party risk assessment, risk assessments

While vendor relationships can help organizations save money, they also introduce risks and hidden costs. This eBook explores these hidden costs, the consequences of missed risks, and how to manage them.

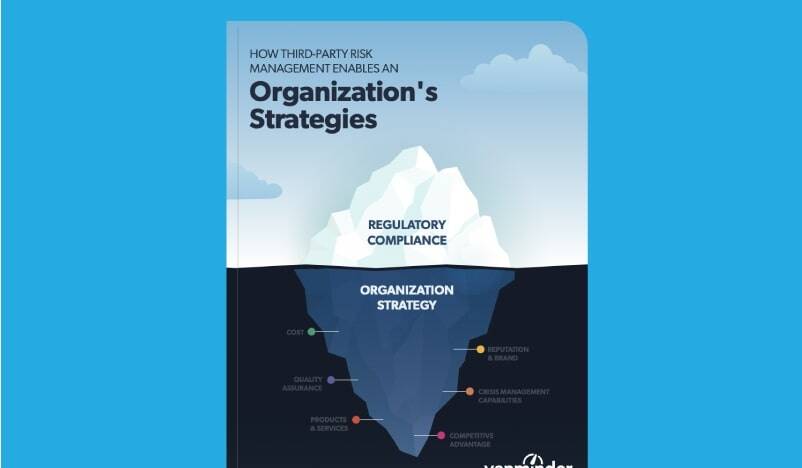

vendor management, third-party risk management lifecycle, strategic enabler, regulatory compliance, organization strategy

Identifying critical vendors is a necessary process that drives many TPRM activities. In this infographic, learn how to identify which vendors are critical to your organization.

high risk, identifying critical vendor, critical vendor overview, high risk vendor

Inherent and residual third-party risk are interconnected, but they do have differences you should be aware of. Learn the differences between them and how they can affect your organization in this eBook.

vendor management, third-party risk management lifecycle, strategic enabler, regulatory compliance, organization strategy

Writing and updating a third-party risk management policy is known to be time-consuming and without guidance or help, it can be challenging to know where to start. Download this template with accompanying instructions and guide to get started.

free policy template, vendor management policy, third-party risk management policy, policy updates

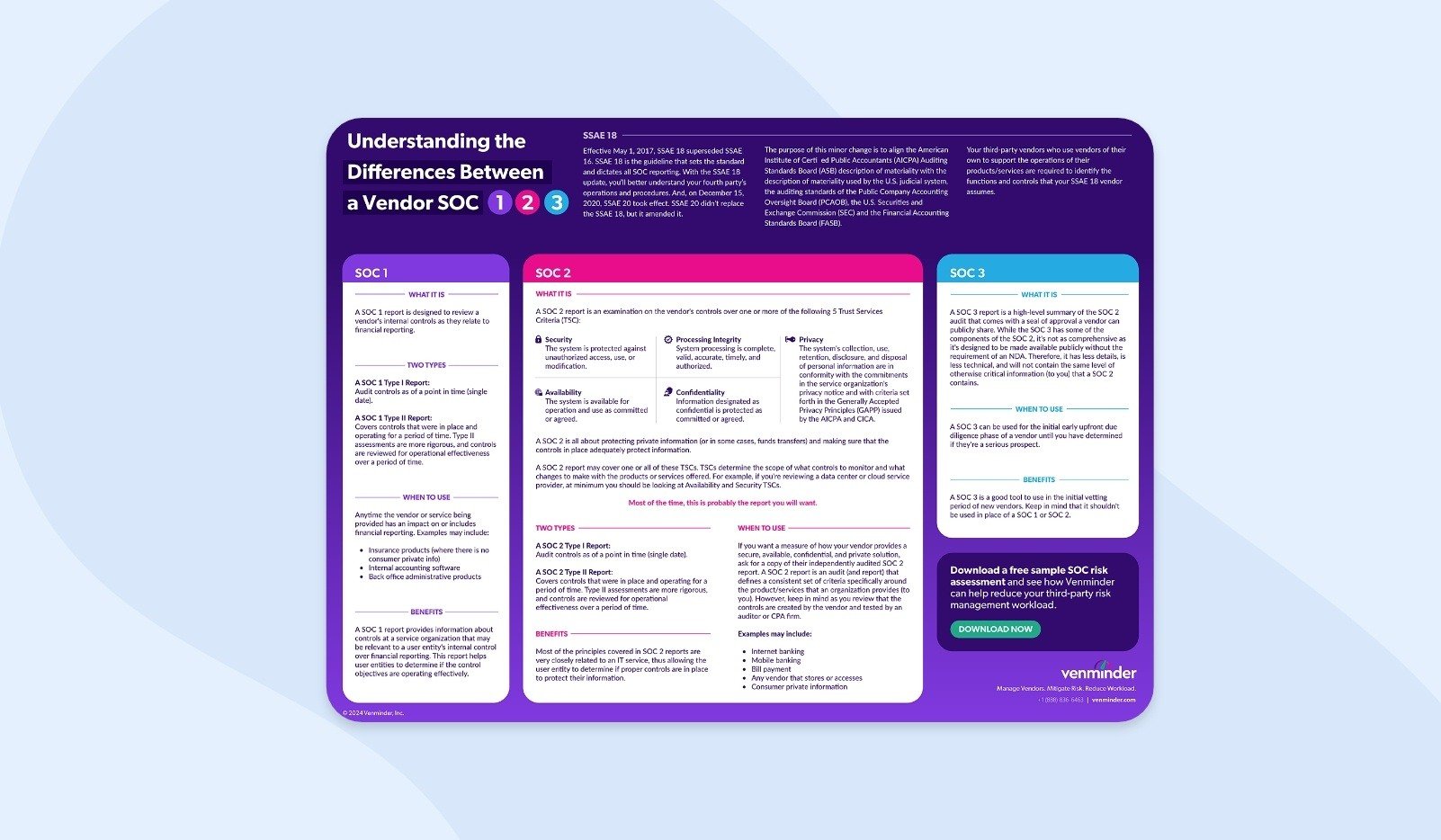

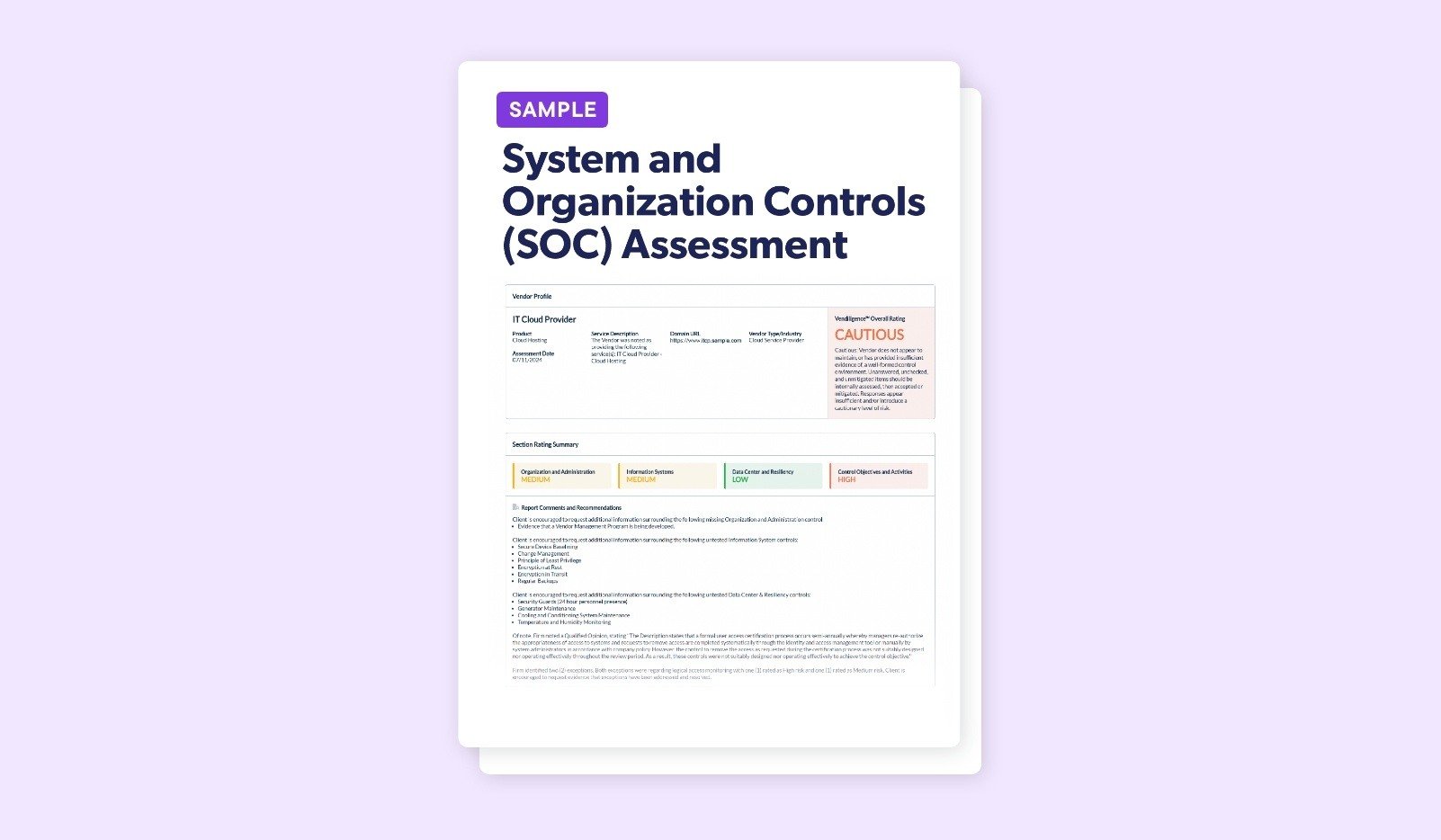

Learn how to review a vendor SOC report, when to obtain and review a vendor SOC, and key areas to look for.

vendor management, security organization controls, vendor risk

International vendors require unique considerations during the due diligence and contracting process. Learn what to review in this infographic.

due diligence, contract management, overseas, international vendors, international vendor management

Are you prepared for third-party vendor data breach? As cyberattacks occur more frequently, learn next steps to take.

vendor data breach, suffered data breach, vendor data breach next steps, cyber attack next steps

Artificial intelligence (AI) is becoming more prevalent in many organizations - it's no longer a matter of if your vendor is using AI, it's a matter of how. And there's still uncertainties with its risks. Use this questionnaire to get started.

ai vendor risk, ai risk, ai template, ai questionnaire, free ai questionnaire, ai sample vendor questionnaire, artificial intelligence vendor risk

This infographic covers why the board and senior management should set the "tone-from-the-top", responsibility guidelines, and tips to help you gain support.

Organizational buy-in, vendor owners, vendor managers, board of directors, reporting, data

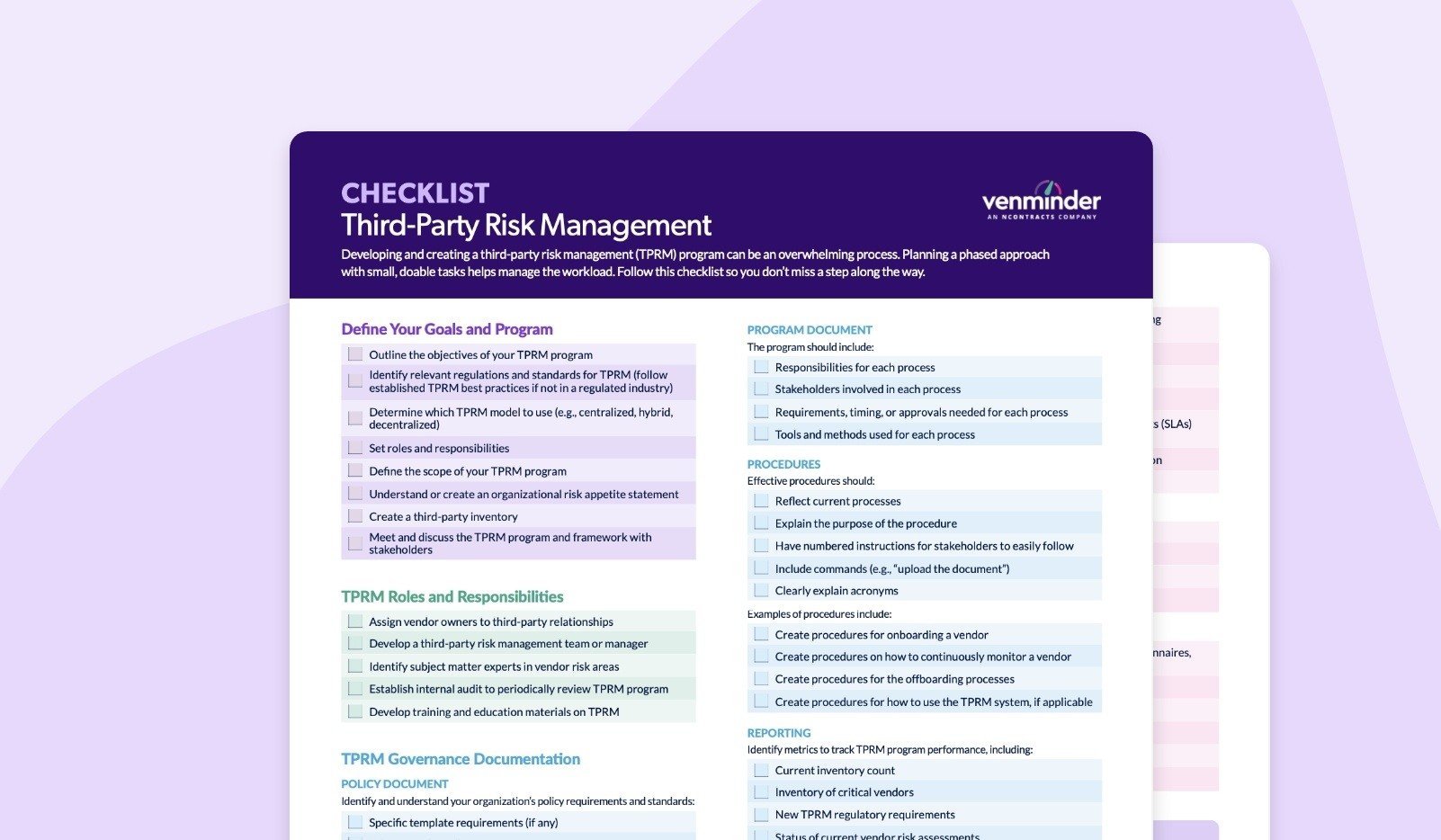

This checklist for creating and implementing a third-party risk management program is designed to help you identify, assess, manage, and mitigate third-party risks. Follow these practical steps to get your program started.

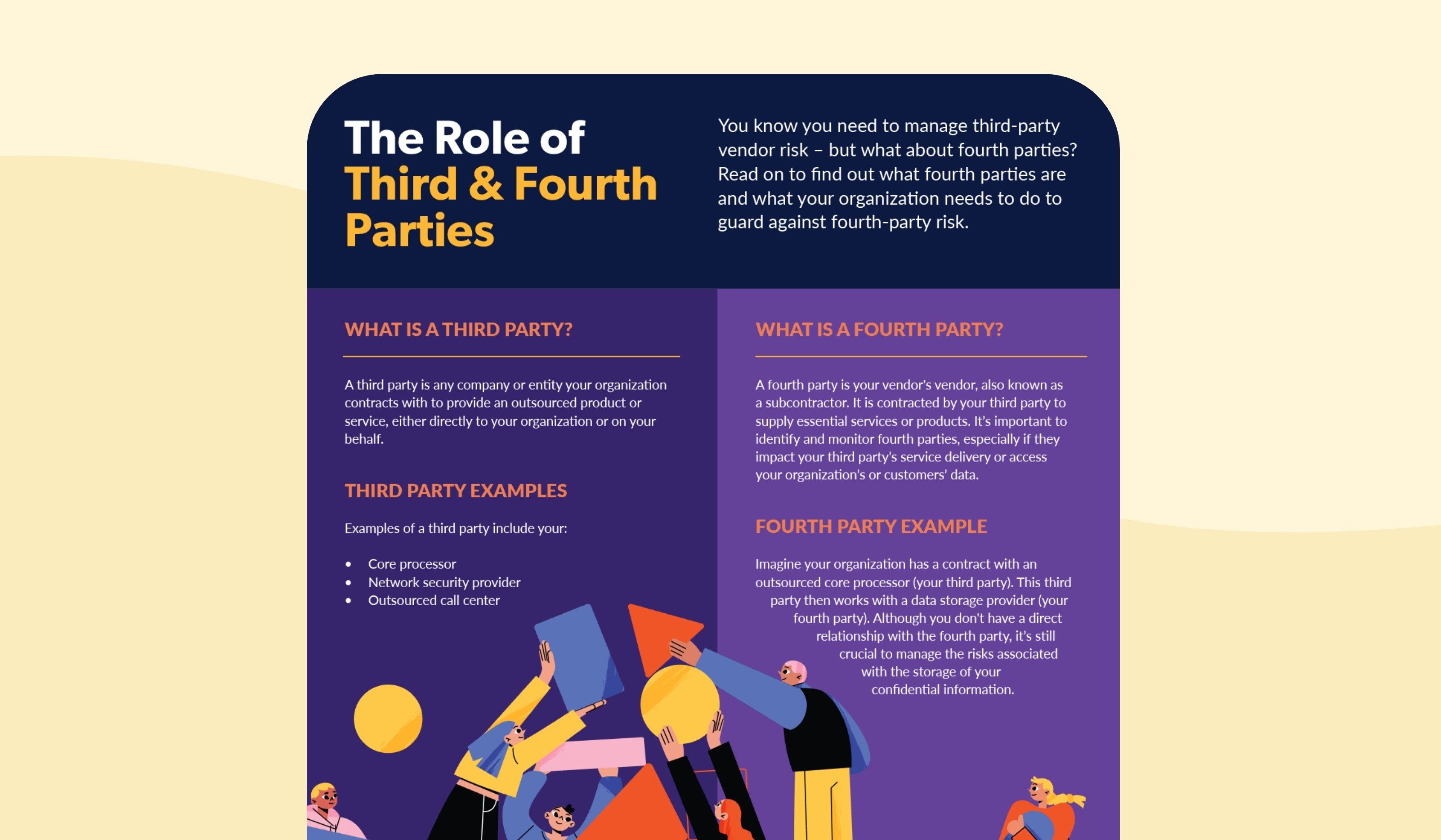

You likely know the importance of managing third-party risks, but what should you do about fourth parties? Fourth parties are essentially your vendor's vendor, or a subcontractor.

Selecting a new vendor can be an exciting yet daunting task. Your organization must identify the right product or service, assess vendor risks, collect due diligence documentation, and remediate any issues. Learn how to select a new vendor in this infographic.

vendor selection, new vendor, vendor onboarding

Third-party risk management (TPRM) governance documentation is the foundation for managing vendor relationships. The policy, program, and procedures define the rules, requirements, and expectations for your organizations TPRM program.

Navigating vendor risk management is filled with challenges and roadblocks. As you manage changing and emerging vendor risks, essential practices like risk assessments, due diligence, contract management, and continuous monitoring will keep you on course.

vendor management

Make sure your vendor risk management program is successful, here 7 are the seven critical items that you need to focus on.

vendor risk management program, vrm program, tprm program, vendor management program, successful program management

Vendor scorecards are a valuable tool to help you track and measure vendor performance. Download this eBook and template to improve your understanding of vendor performance metrics.

vendor vetting, ongoing monitoring, vendor management, performance monitoring, vendor scorecard

For many organizations, managing third parties throughout the entire relationship can be challenging. Utilizing the third-party risk management lifecycle can help. Learn more in this podcast.

tprm lifecycle, lifecycle management, vendor management lifecycle, risk lifecycle, vendor risk lifecycle

Use this as your guide to understand vendor risk management takeaways from the SEC's recent examination priorities report.

vendor risk management, SEC examinations, SEC, regulations, guidance, regulator, guidelines, cybersecurity report, observations resiliency reports

Regulatory guidance and best practices can change, so it's worth reviewing new information as it becomes available. This eBook contains tips to comply with third-party risk management guidelines across different industries and around the globe.

Interagency Guidance, OCC, FDIC, FTC, The fed, FFIEC, CFPB, Securities and Exchange Commission, SEC, NCUA, HHS, tprm regulations, tprm guidance

Learn more about the specific differences between high-risk and critical vendors with this helpful infographic.

high risk vendor, critical vendor, differences between high risk critical vendors

As artificial intelligence becomes more prevalent in vendor products and services, it's crucial to understand how to address the risks in your vendor contracts. This infographic will give you considerations for contract planning, provisions to include, and more.

artificial intelligence risk, ai risk, vendor ai risk, ai considerations, ai vendor contracts

Your organization is solely responsible for implementing CUECs, and failing to do so means your organization isn’t protected from known vendor risks. By identifying, reviewing, and mapping vendor CUECs, your organization can ensure the right controls are implemented.

vendor cuecs, soc report cuecs, complementary user entity controls, mapping cuecs, vendor soc controls,

Third-party risk management is becoming a larger focus area, not only for the OCC, but also for other regulators across the financial industry. Reading and understanding these regulations can help strengthen your compliance program and ensure it's headed in the right direction.

OCC exam priorities, examination priorities, regulatory exam, vendor exam, occ regulations, occ priorities

As you review the cybersecurity information provided, you'll notice that vendors often have a wide assortment of cybersecurity documents available. To help, this infographic breaks down the types of evidence to collect from vendors.

vendor cybersecurity, cybersecurity documents, document collection, vendor cybersecurity documents

Take steps to protect your organization from vendor cybersecurity risk. Listen to this podcast for 6 steps to manage third-party cybersecurity risk.

As cybersecurity risk continues to evolve it's getting more challenging to identify and manage. Learn next steps to address a vendor's poor cybersecurity practices in this infographic.

poor cybersecurity practices, cybersecurity red flags, vendor cybersecurity risk, cybersecurity practices

Ensure you're getting the most out of your third-party risk management resources. Download this eBook to get a better understanding of which of your third parties or vendors are determined in scope or out of scope.

vendor management, exclusion, inclusion, in scope third parties, out of scope third parties

Lean third-party risk management teams and large vendor inventories only add to the complexity and work effort, especially if the program's TPRM process involves manual processes, etc. In this eBook learn how TPRM platforms support your program, regardless of maturity.

outsourcing tprm, outsourced vendor management, when to outsource, outsourcing vendor management processes, outsourcing tprm task, mature program, new program

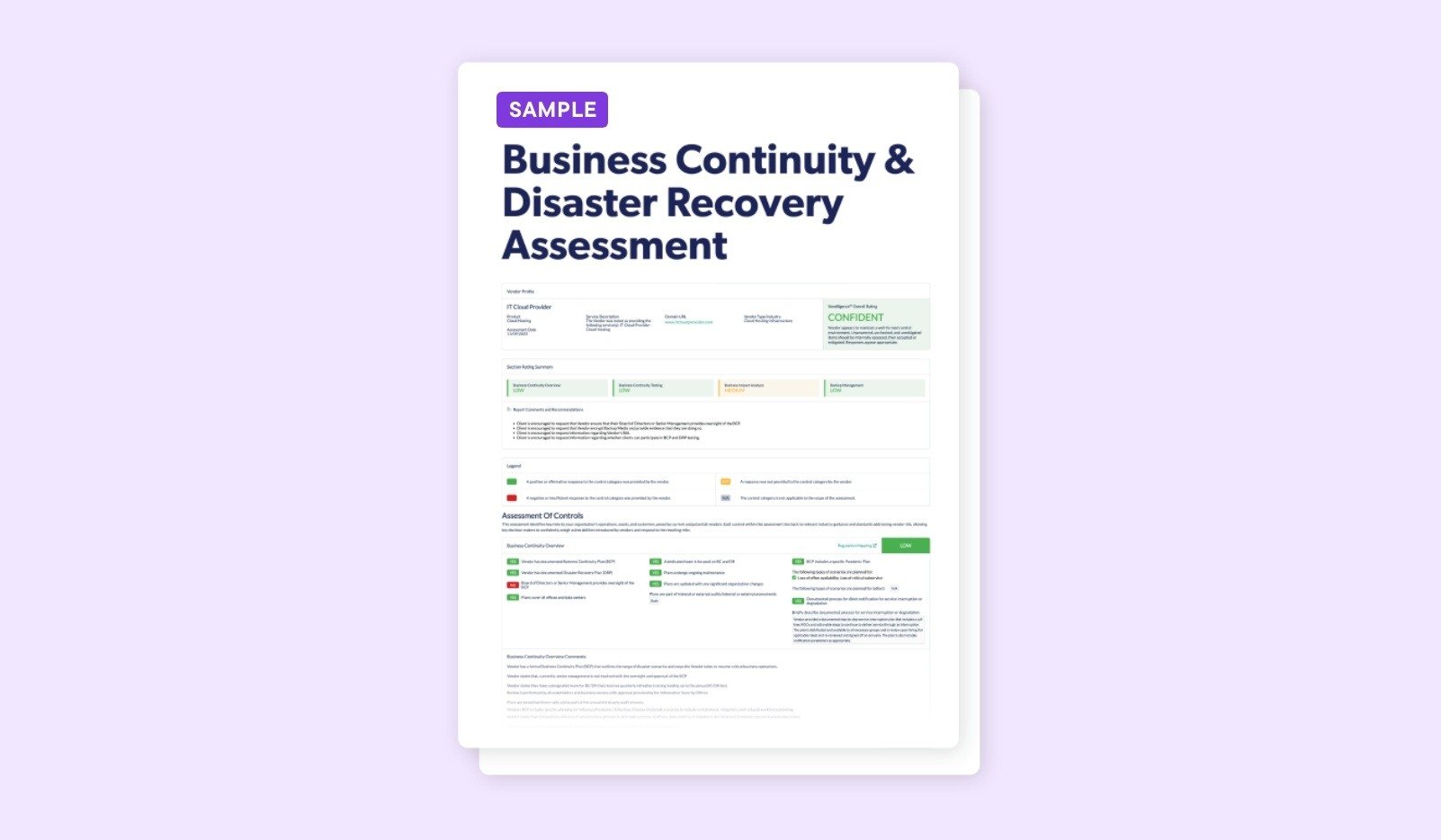

This infographic breaks down the elements you should look for in vendor business continuity and disaster recovery plans.

bdcr, bcdr plans, bcp, drp, business continuity management, business impact analysis

There are three vendor risk management frameworks to consider: centralized, decentralized and a hybrid approach. We'll teach you the differences and guide you toward the best framework for you.

Ongoing monitoring isn't a one-time process, but rather a series of activities based on the third party's risk. Learn tips and best practices for ongoing monitoring in this eBook.

third-party ongoing monitoring, ongoing monitoring, monitoring third-party risk, risk monitoring, continuous monitoring

Mapping out your annual budget for third-party risk management can be challenging. Developing a budget roadmap is one way to tackle these challenges head on. Download the eBook to learn more.

third-party risk budget, budgeting, budget roadmaps, vendor management budget, tprm budget, budget allocation

Lack of preparation in advance of the contract end date leaves little time for negotiation or modification. Mid-term contract reviews are effective to ensure your vendors continue to deliver products and services as expected.

vendor contract management, contract assessment, mid-term agreement, vendor agreement

Incorporate sound contract compliance techniques to lessen exposure to vendor risk and improve contract management practices. Use these techniques to help you with the process.

contract negotiation, contracts, vendor contract compliance, vendor contracting, contract management

If your organization is in a regulated industry, you should anticipate regular examinations. It's good to review your regulators website to become familiar with their exam process, classification of issues, etc. In this podcast, learn common exam findings and next steps.

vendor management exams, vendor management exam findings, tprm exam findings, tprm exam, third-party risk management exams

As organizations continue to rely on outsourced products and services, the rapid deployment and wide variety of AI use brings about many news risks that require careful consideration. This eBook explores the risks associated with third-party AI.

third-party ai, ai risks, third-party ai risk, vendor ai risk, artificial intelligence risks

Download the infographic to learn the definitions of each type of SOC report and how they can benefit your organization.

information security, soc report, vendor soc, vendor soc 1, vendor soc 2, vendor soc 3

Vendor performance must be closely monitored and tracked to ensure it remains at the expected level outlined in the service level agreement. Learn how to use key performance indicators to maintain SLAs in this eBook.

strong vendor relationships, kpis, key performance indicator usage, strong SLAs, maintaining slas

Vendor data breaches can range in severity, from minor incidents to significant events that create operational failures and require public disclosure. Protect your organization by learning about the different categories and types of vendor data breaches.

vendor breach, data breach, types of data breaches, tips to prevent breaches, breach, third-party breach

A vendor's insurance can reduce the financial risk posed to your organization. This eBook explains how your organization can better align its use of vendor insurance coverage as a risk mitigation technique.

vendor insurance, insurance coverage, financial liability, reduce financial liability, third-party insurance, certificate of insurance

Anyone who's involved in vendor risk management knows the intricacies of the various tasks. In this podcast, learn tips and commons ways you can utilize VRM software to streamline your processes

vrm software, tprm software, streamlines processes, streamline vendor management tasks, streamline tprm tasks

There are many consequences that can arise from a vendor’s poor financial performance. In this infographic learn strategies and tips to help your organization use relevant contract language and SLAs to address a vendor’s poor financial health.

poor vendor performance, vendor financial performance, SLA, vendor contracts, service level agreements, track vendor financial health

As relationships between fintech organizations and credit unions have revolutionized the industry, third-party risk management has become more crucial for both parties to have. Learn how third-party risk management has evolved for credit unions and fintech in this panel interview.

fintech, credit union, panel interview, industry expert interview, financial technology

The North American Electric Reliability Coporation's (NERC) standard, CIP-013-1 Cyber Security - Supply Chain Risk Management requires effective vendor risk management in the energy industry. Learn how to comply in this eBook.

nerc regulation, north american reliability corporation vendor management, vendor risk management regulation, energy organization, energy company, energy risk management

Vendor risk management is a complex practices that requires a thorough understanding of your organization's objectives, regulatory requirements, and vendors' business practices. Follow the tips and best practices in this mini handbook to help you maintain an effective vendor risk management program.

vendor management, third party risk management, vendor management handbook, risk management handbook

With the number of vendors in an organization, it may not always be obvious where a vendor sits on the high-low value spectrum. This eBook will help you determine who your low and high-value vendors are, and how to get the best value from your vendors.

vendor quality, vendor risk, operational risk, reputation damage, due diligence, performance management, vendor owner, vendor manager

While you can't eliminate all the risks posed by your vendors, you can reduce them by following the steps of the third-party risk management lifecycle. Watch this video to learn how to effectively manage third-party risk.

mitigate third-party risk, managing vendor risk, mitigate vendor risk, how to manage vendor risk, effective tprm, effective vendor management, third-party risks, vendor risks

Managing vendor risks is crucial to the success of any business. It requires identifying all potential risk associated with products and services provided by a vendor. Learn the steps to complete the vendor risk assessment process in this infographic.

vendor risk, vendor profiling, questionnaires, risk assessment process, assessing vendors

Vendor due diligence is one of the most vital activities within third-party risk management. But, it's not always clear when and how often vendor due diligence should be done. By following these recommended guidelines for the frequency of due diligence, you can ensure your time and efforts are well spent.

vendor due diligence process, perform due diligence, perform vendor due diligence, when to perform due diligence, how often perform due diligence

The success of a TPRM program depends on a carefully integrated combination of rules, tools processes, and people. In this eBook, learn the existing roadmap, known as the third-party/vendor risk management lifecycle and more.

vendor risk management, risk management, third-party risk management lifecycle, vendor risk, mitigate risk

This complimentary toolkit includes reporting (annual and monthly) templates and provides you with guidance on how to format vendor board reports.

third-party risk reports, board reporting, report vendor risk management activity, report third-party risk management activity, reporting

One of the first activities in the third-party risk management lifecycle is completing an inherent risk assessment. This process identifies the different types and levels of inherent risk, which occur naturally within the vendor’s product or service. Learn the steps to complete an inherent risk assessment in this infographic.

vendor inherent risk, risk assessment process, vendor risk assessments, how to complete risk assessments, due diligence

In this podcast we’ll discuss 4 important vendor risk management frequently asked questions for beginners to help get you started. The questions like: what vendor risk management is, why it’s important, who is involved and how vendor risk is completed.

vendor risk management beginner, beginner tprm, tprm frequently asked questions, beginner vrm, vendor management question, third-party risk management questions

It's critical to take into account recent best practices in order to be as prepared as possible for vendor management. This eBook has 31 best practices everyone should know.

vendor management best practices, best practices, third-party risk best practices, vendor risk best practices

The first stage in a third-party risk management program is onboarding any new vendor. There's a lot to consider in this stage, including risk assessments, due diligence, and more. This toolkit will help ensure your vendor relationships starts of on the right foot.

how to onboard vendor, vendor onboarding, onboarding vendors, steps onboarding vendor, stage of lifecycle, third-party risk management lifecycle onboarding

As part of vendor risk management, you need to know your third party's financial condition. Download a free analysis on your core vendor now.

financial health sample, sample, free assessment

Maintaining regulatory compliance with third-party vendors can be challenging, especially when it comes to cybersecurity guidance and state privacy laws. Learn key cybersecurity regulations and tips to strengthen compliance in this infographic.

vendor cybersecurity, cybersecurity preparation, preparing for cybersecurity regulations, state privacy laws

Cybersecurity threats will always exist, but maintaining regulatory compliance can help your organization prevent and respond to events more effectively. Learn who must comply with 23 NYCRR 500, highlights of the regulation, and more.

regulatory compliance, guidance

Building a fourth-party vendor inventory can be challenging, but it's crucial to protect your organization from an extensive risk landscape. This podcast explains how to build a fourth-party vendor inventory and tips to keep in mind.

vendor inventory, inventor building, fourth-party risk, fourth parties, build inventory, tips building vendor inventory

Reviewing a vendor’s financials is an essential step of every successful third-party risk management program. Comparing this data to financial benchmarks is an effective strategy that can bring greater clarity to your vendor’s financial health. Learn more in the eBook.

vendor financial benchmarks, financial reviews, benchmarking, reviewing financial data, financial data, third-party financial review, third-party financial benchmarks

Use this as your guide to understand vendor risk management takeaways from the SEC's recent examination priorities report.

vendor risk management, SEC examinations, SEC, regulations, guidance, regulator, guidelines, cybersecurity report, observations resiliency reports

Conducting risk-based due diligence on your vendors can help you streamline your vendor reviews. In this podcast, learn 3 ways risk-based due diligence can improve your efficiency.

risk-based due diligence, vendor risk due diligence, risk-based, due diligence, vendor due diligence, conduct due diligence, risk assessment, risk profiling

In this thought leadership interview, Rachael Ormiston, Head of Privacy at Osano discusses how to implement vendor privacy scores in your third-party risk management practices.

privacy score, vendor privacy, privacy score benefits, privacy risk

Reviewing a vendor's business continuity and disaster recovery plans is an essential step in your due diligence process. A weak finding as you assess plans should be concerning, as this can expose your organization to significant risks. Learn more in the infographic.

business continuity testing, bcp, business continuity planning, weak bc/dr plans, weak business continuity, vendor business continuity, vendor disaster recovery

Third-party risk management is a highly rewarding practice for an organization and its stakeholders, but it can be difficult to understand the value this practice can bring. This business case for third-party risk management explores why your organization should invest in this essential area.

business case tprm, tprm business case, vendor management business case, outsourcing risk, outsourcing third-party risk management activities, buy-in, invest third-party risk management

Effective vendor contract management has many benefits that all organizations can experience, including potential cost savings and safer third-party vendor relationships. Learn effective contract management practices in the infographic.

vendor contract management, vendor contract risk, contract management risk, vendor contracts, contract risk, effective contract management, contract management practices

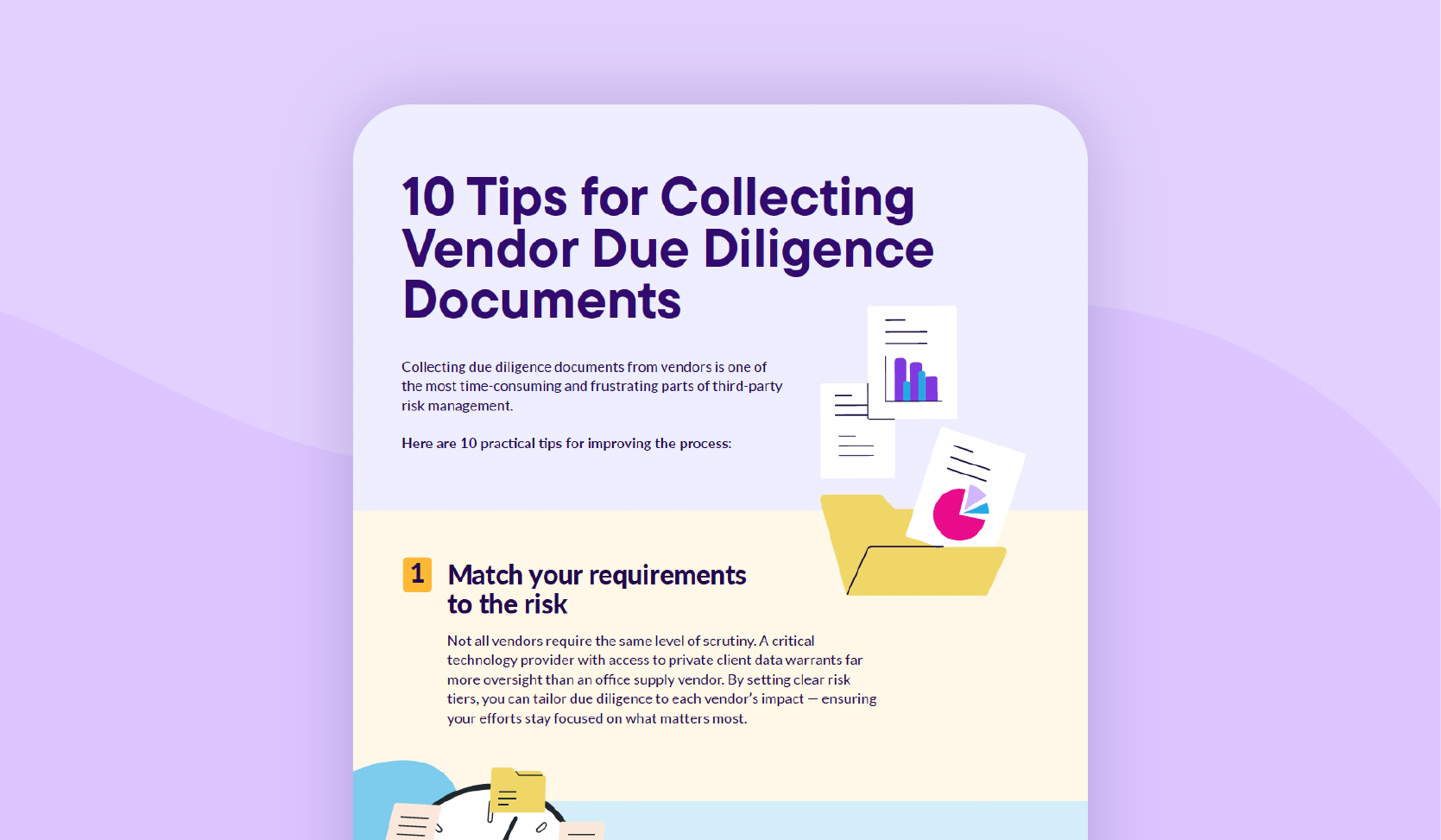

Without the right documents, your vendor risk assessment can't be completed correctly, if at all. In this infographic, learn best practices and tips to improve document collection efficiency.

document collection, vendor due diligence, due diligence, vendor documents, documents

New to third-party risk management or looking to stay up-to-date on a wide range of industry topics? This interactive guide is full of resources for beginners.

vendor management, risk management, third-party risk management resources

Level up your third-party risk management knowledge with this interactive guide. Continually improve your knowledge, program and more!

vendor management, risk management, third-party risk management resources

Understanding the key roles involved in third-party risk management is important to you and your organization. Learn their responsibilities and how they fit into your third-party risk management program.

vendor management, involvement, staffing

Having an effective planning process will justify the need, cost, and benefits of a vendor relationship and start your onboarding process on the right foot.

onboarding a vendor, planning onboarding, planning steps,

For the vendor performance management process to be effective, organizations must think carefully and plan ahead. An effective process helps reduce costs, enhance customer satisfaction, mitigate risks, and more.

vendor performance, performance management, performance process, vendor performance process, managing vendor performance, performance questions

The economy has faced many challenges the past few years. These events present many challenges for organizations, and some are looking to cut costs. But, reducing TPRM may be a mistake as it can help protect your organization.

reduce costs, cut third-party risk management, economic climate, cutting costs, reduce budget

The program document answers the "how" of each third-party risk management activity. In this infographic, learn how to write an effective third-party risk management program document.

third-party program document, write policy and program, program writing, program document, write third-party risk management program document

Third-party compliance risk can be one of the more challenging areas to manage, but it's necessary to protect your organization from significant consequences. Use the 6 techniques covered in this infographic.

compliance management, vendor compliance, third-party compliance, manage compliance risk, manage vendor compliance

In this thought leadership interview, Andrew Moyad, CEO at Shared Assessments, discusses the importance of cyber insurance in third-party risk management. Learn what it covers and how it can help protect your organization from third-party cyber risk.

vendor cybersecurity, cyber insurance, cybersecurity insurance, infosec insurance, cybersecurity risk

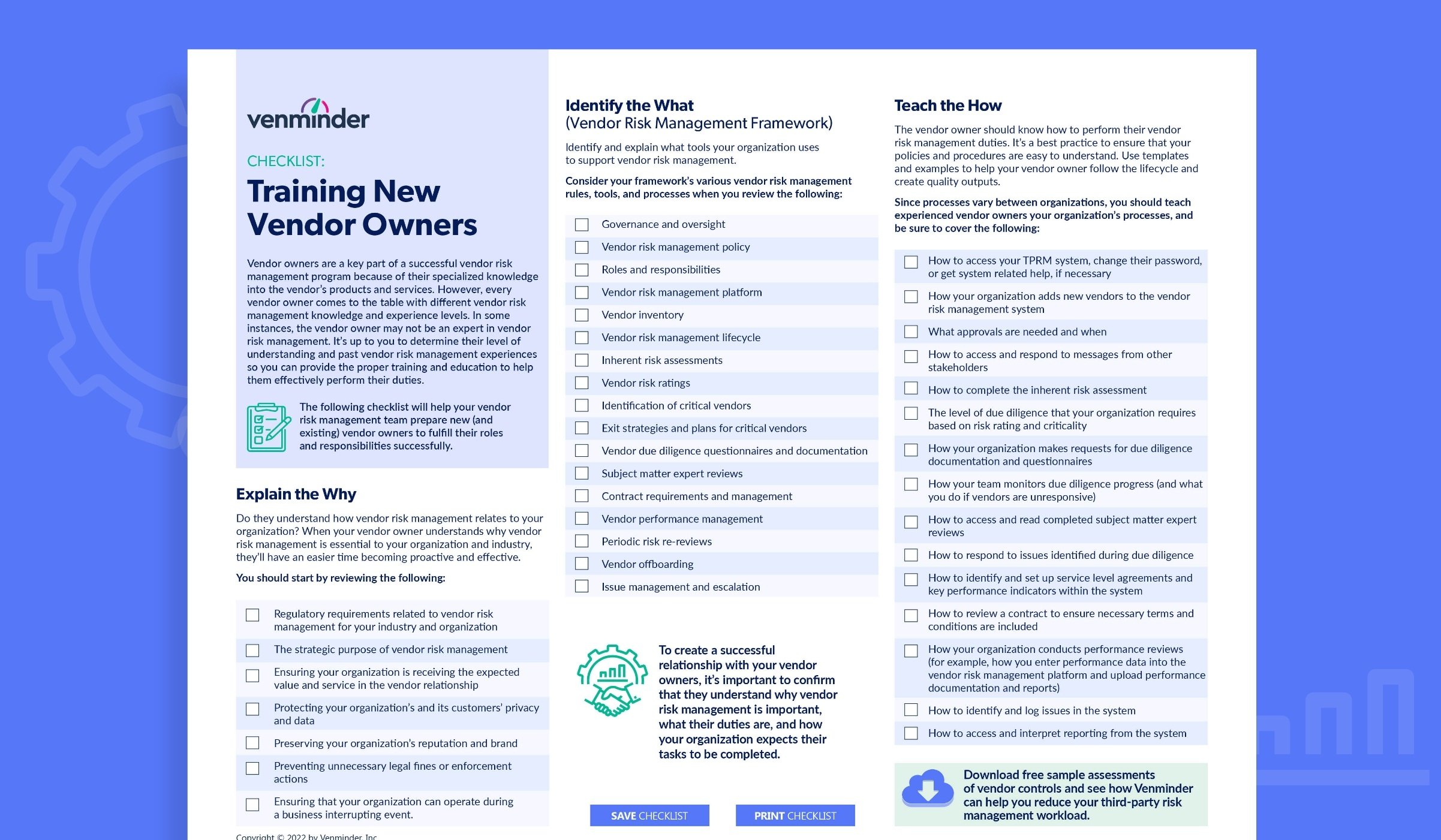

Have new or existing vendor owners that need to be trained? This checklist will help your vendor risk management team prepare vendor owners to fulfill their roles and responsibilities.

checklist, vendor owners, vendor management, vendor manager

When you learn the key steps, building a vendor risk management program doesn't have to be an overwhelming task. Organizations of all sizes can build a program that will satisfy regulators and manage vendor risk.

vendor management, effective vendor risk management program, program building, building a program, vendor risk management program

Learn 4 key recommendations to implement in your third-party risk management programs to mitigate third-party risk this upcoming year. Listen now.

third-party risk management best practices, tprm best practices 2024, third-party risk recommendations, tprm recommendations, best practices for 2024, cybersecurity recommendations, data breach recommendations, due diligence recommendations

There isn’t a one-size-fits-all solution to third-party risk management policies. This eBook will help you understand the dos and don'ts for creating a policy and best practices.

vendor risk management policy, risk management policy, creating policy, updating policy, tprm policy, third-party risk policy

Defining the roles and responsibilities within your TPRM program is crucial for success. Learn how to implement the RACI method with this infographic and customizable template.

raci method, roles and responsibilities, tprm roles, tprm responsibilities, organizational structure

In this thought leadership interview, Tom Rogers, Vendor Centric, defines the characteristics that make up a fourth-party vendor and uncovers the steps to manage them. Listen to this interview to learn about fourth-party due diligence, regulations, and best practices.

fourth parties, fourth-party vendor, thought leader interview, managing vendors

Learn best practices that should be included in your third-party risk management program to ensure you keep your organization protected from data breaches and other cybersecurity incidents.

third party risk trends, third-party risk management, best practices, tprm best practices, tprm trends, svb, republic bank, signature bank

Without collaboration, organizations can face many challenges. In the eBook, explore some ways InfoSec and TPRM can proactively partner to benefit both teams.

information security, collaboration, better risk management, collaboration benefits

Learn the necessary actions to comply with Canada's Office of the Superintendent of Financial Institutions (OSFI) final Third-Party Risk Management Guideline B-10.

regulations, governance, compliance, FRFI, federally regulated financial institutions

If your organization doesn't have the right vendor risk management practices, your organization's and customers' data is at risk. To protect data, you must understand how your vendors plan to use it and safeguard it.

data privacy, cybersecurity, information security, lines of defense, third-party risk management lifecycle, documenting, reporting

Vendor data breaches will always be unexpected, but it’s possible to anticipate your response, which can minimize the damage to your organization and customers.

cybersecurity, information security, breach notification, data privacy, reputational damage, operational disruptions, cybersecurity posture

It's increasingly common for healthcare organizations to experience a data breach stemming from a business associate. Learn the 6 key steps to prepare your organization for a breach.

data privacy, reputational damage, operational disruptions, breach notification, information security, cybersecurity

An effective third-party risk management program provides many strategic advantages to an organization. One obvious benefit is meeting regulatory requirements, but there's a much broader range of benefits.

SLA, service level agreement, operational advantages, outsourcing

Learn best practices that should be included in your third-party risk management program to ensure you keep your organization protected from data breaches and other cybersecurity incidents.

breach notifications, cyber right to audit, data protection, information security, data privacy, infosec

While technology sophistication is growing, so are the capabilities of hackers. Use this infographic to learn how to build a solid defense against cybersecurity risks.

data breach, information security

Mike Morris talks about the proposed SEC Outsourcing Rule and its impact in vendor risk management. Listen to learn answers to common questions, tips, and suggestions, as well as a general overview of the proposed rule.

regulations, financial services, fintech, guidance, registered investment advisors

This eBook explores how you can articulate the many requirements and benefits for your stakeholders to enhance their understanding and improve their third-party risk management program buy-in.

board reporting, stakeholder buy in, vendor owners, vendor managers, implementing third-party risk management platform, outsourcing,

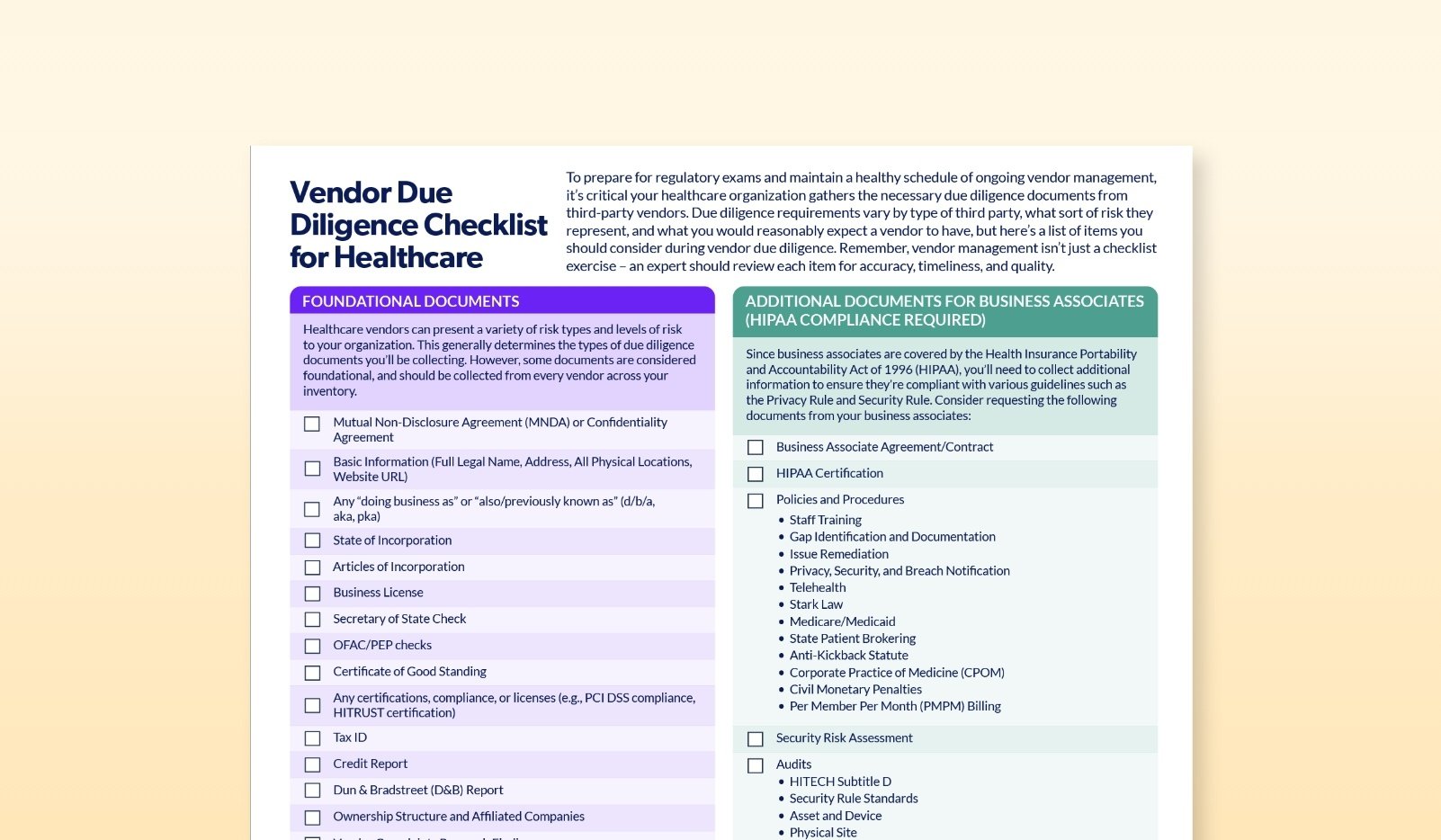

There are many due diligence considerations unique to healthcare organizations. Use this handy checklist when thinking through the vendor due diligence you should be assessing, and the foundational documents to request from every vendor.

document collection, ongoing monitoring, continuous monitoring, hipaa compliance, ongoing vendor management, business associates

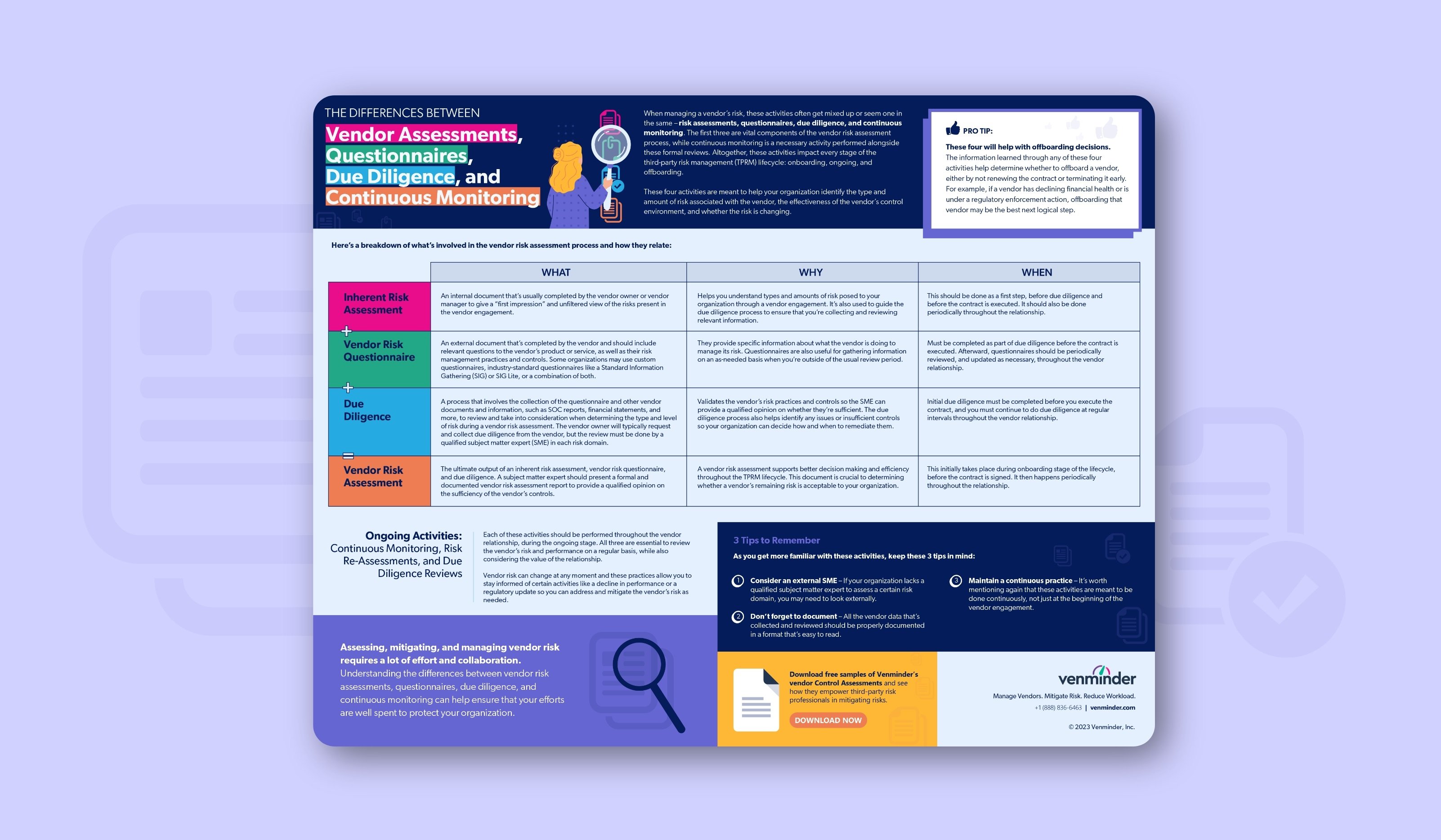

While all are important, there are differences to be aware of between questionnaires, risk assessments, due diligence, and continuous monitoring.

ongoing monitoring, risk re-assessments, vendor offboarding, third-party risk management lifecycle

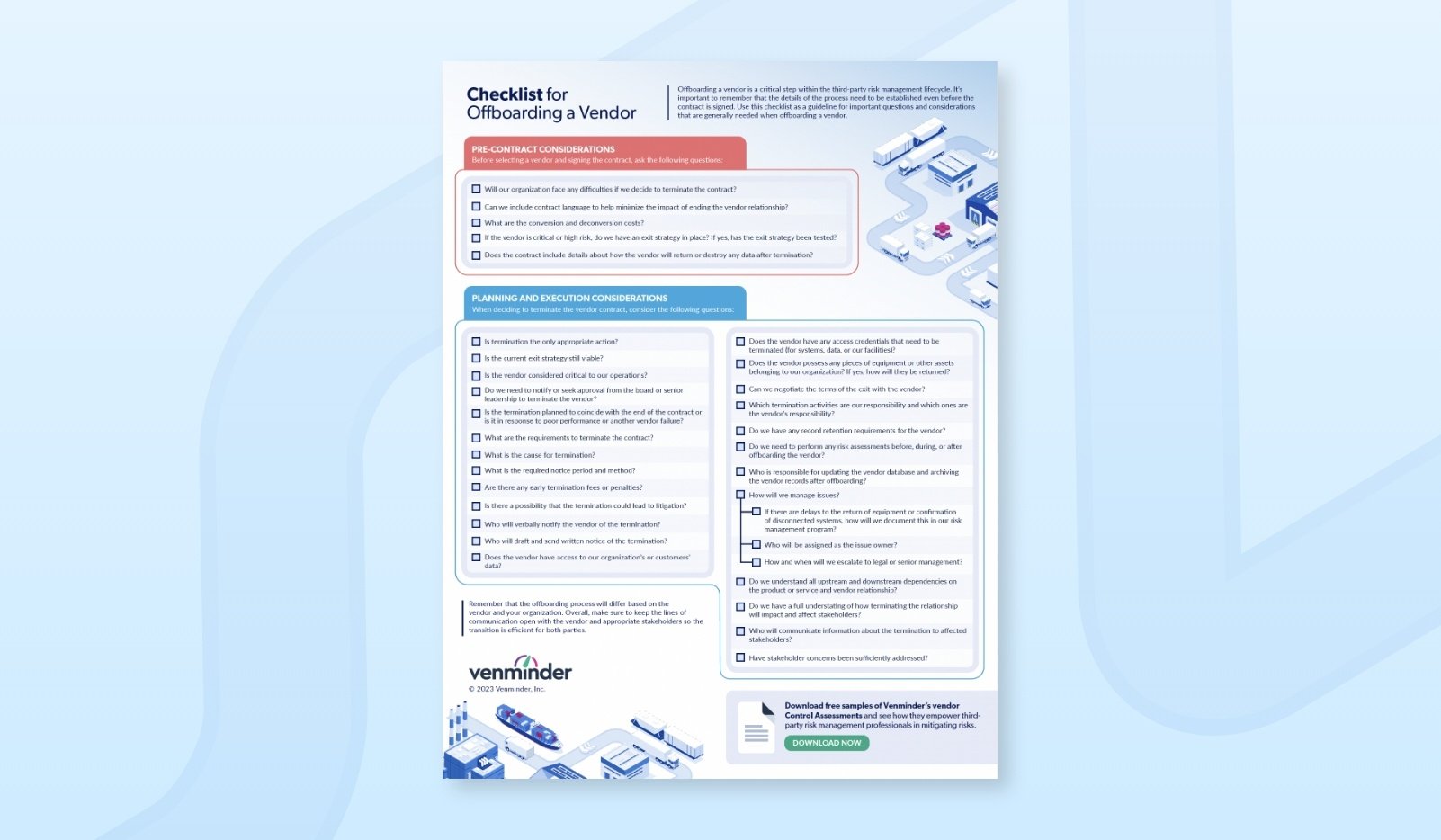

Offboarding a vendor is a critical step within the third-party risk management lifecycle. The process will differ based on the vendor and your organization, and details of the offboarding process need to be established before the contract is signed. Use this checklist for important considerations when offboarding a vendor.

offboarding a vendor, vendor offboarding, offboarding, exit strategy, offboarding checklist

The Board, FDIC, and OCC released the official interagency guidance on managing third-party relationships. This eBook gives you 7 takeaways you should be aware of.

regulations, banking, vendor scope, critical vendors, due diligence, ongoing monitoring, documentation, reporting

Regulatory examiners have distinct expectations when it comes to the boards involvement in third-party risk management. Listen to learn the board's place in regulatory exams, and how you can lend a helping hand.

TPRM, regulations, regulatory exams, contract management, audit, due diligence

Learn the key takeaways from important third-party risk regulatory guidance released by the OCC, FDIC and FFIEC from our compliance expert.

regulatory guidance

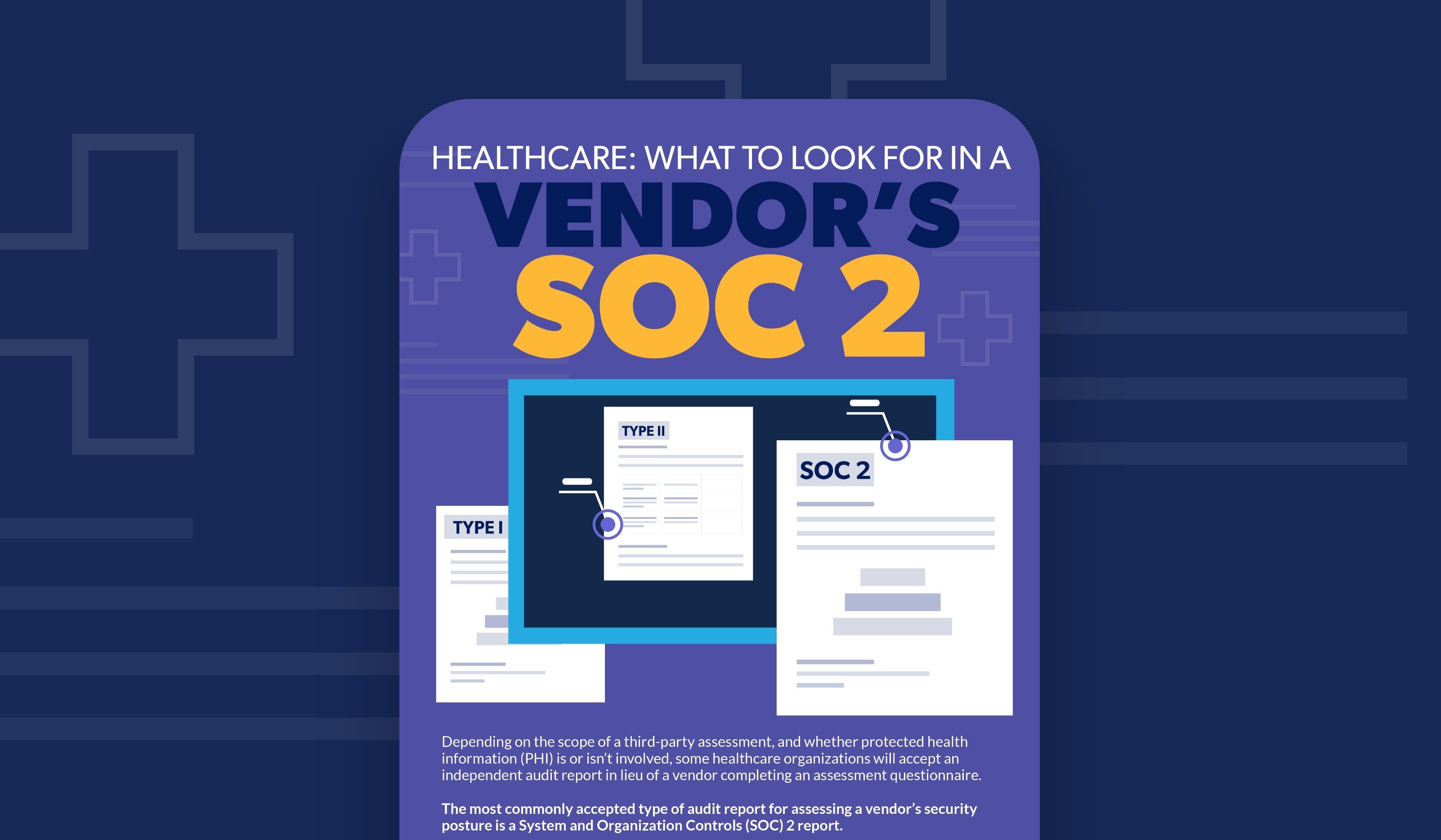

Some healthcare organizations will accept an independent audit report in lieu of a vendor completing an assessment questionnaire. In this infographic learn what to look for in a vendor's SOC 2 Type II audit report and key elements to review.

risk posture, risk assessment, audit report, cybersecurity, PHI, protected health information, healthcare due diligence

Larger vendors can be more difficult to manage. Learn essential tips and best practices to mitigate vendor risk with your large vendors in this podcast.

large vendor inventory, large vendors, vendor risk, mitigate vendor risk, mitigate large vendor risk, manage large vendors

What do you do if a vendor's SOC report is filled with issues? Use this infographic as a guide to determine how to proceed with the vendor, whether that's addressing the issues or passing on the vendor relationship.

cybersecurity, due diligence, regulatory audit, vendor offboarding, controls

This eBook explains what vendor risk management is and how you can implement it. Done right, a good vendor risk management program creates a real strategic advantage for your utility company.

risk mitigation, continuous monitoring, ongoing monitoring, third-party risk management

Use this infographic as a guideline for important data to collect and continuously update. Ensure that the appropriate stakeholders are well-informed to drive action in your third-party risk management program.

document collection, risk assessment, ongoing monitoring, issue management, Inventory

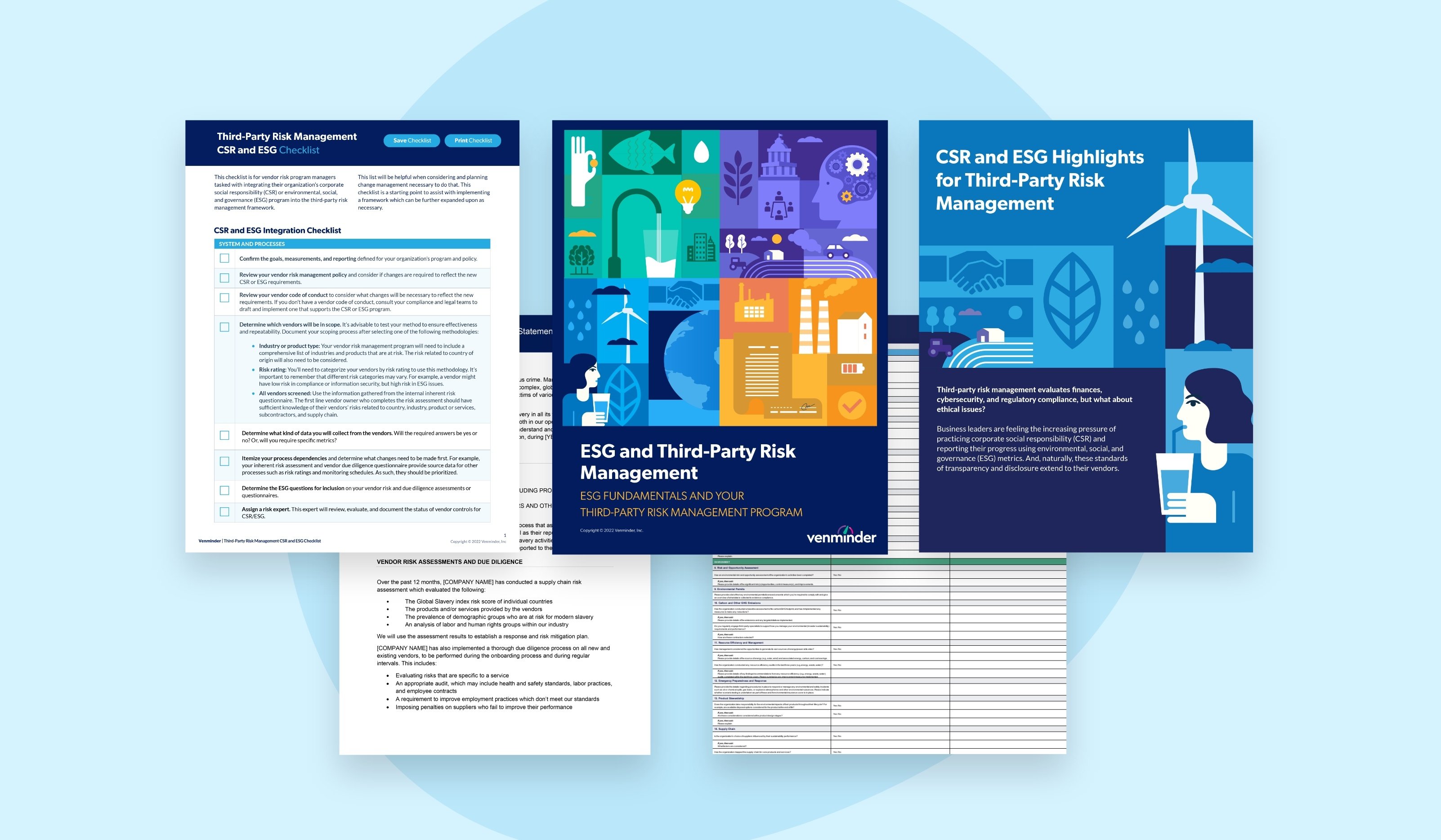

ESG is a rapidly growing business principle that aims to better measure the success and sustainability of an organization. This eBook provides steps to implement ESG into your TPRM program successfully

CSR, corporate social responsibility, environmental, social, governance

By understanding your vendor's cybersecurity posture and doing the appropriate steps to prevent risk, you can reduce the chances of your healthcare third parties compromising you.

inherent risk, due diligence, information security, infosec, controls, HITRUST, data breach

Not all vendors have the same level of risk. Risk-based vendor due diligence can save your organization time and resources in your vendor risk management program. But, do you know the steps to take and when? This informative video explains the 7 steps.

third-party risk management lifecycle, inherent risk, risk level, risk questionnaire, critical vendor, low-risk vendor

Prioritizing TPRM is essential, even if your resources are limited. There are many advantages in utilizing third-party risk management tools. Listen to this podcast to learn more.

third-party risk management resources, leverage resources, tprm resources, limited resources, software

An effective TPRM program requires strategy to identify, address, and resolve any issues in a timely manner. Vendor relationships will never be perfect, issue management is a necessary component that will help prevent larger problems down the line.

issue management, managing vendor issues, vendor issues, risk management issues

Developed by industry experts, you can reference this third-party management glossary for key words in the vendor management process.

third-party risk terms, tprm terms, tprm terminology, understanding third-party risk management terms

Higher education institutions have become increasingly dependent on the utilization of third-party vendors in today's climate. In this eBook, learn the importance between TPRM and higher education.

higher education, school districts, higher education TPRM, higher learning vendor risk

Risk-based vendor due diligence can save your organization valuable time and resources. In this infographic learn what vendor risk-based due diligence is and why it matters

Vendor due diligence, risk-based due diligence, level of risk, due diligence frequency

It's not surprising that most sponsoring small pharma and biotech startups choose to perform their clinical trials with the assistance of CROs. But, not all CROs are created equal, so selecting the right CRO is crucial.

biotech, due diligence, vendor due diligence, contract research organization selection, CROs

Collaboration with vendor owners involves a lot of day-to-day activities, spanning across the three stages of the third-party risk management lifecycle. This podcast outlines tips to improve collaboration between your third-party risk management team and your vendor owners.

vendor owner, training vendor owner, vendor management

Not all of your third-party relationships will end naturally at the end of a contract period. Sometimes, early contract termination is needed, so your organization must be prepared. This eBook outlines the necessary steps.

vendor offboarding, proactive termination, reactive termination, periodic reviews, third-party contracts

Not sure where to begin in implementing a third-party risk management program? Download this eBook to learn the foundational components of a third-party risk management framework.

vendor management, third-party risk management lifecycle, scoping, onboarding, operating model, contract management

Use this as your guide to understand vendor risk management takeaways from the SEC's recent examination priorities report.

vendor risk management, SEC examinations, SEC, regulations, guidance, regulator, guidelines

For a third-party risk assessment to be effective, you must know what kind of data they can access within your network and what kind of data they will access, process, transmit, or store on their networks. Learn more in the infographic.

vendor risk assessment, healthcare risk assessment, healthcare vendor management, healthcare vendor

The HITRUST certification ensures that a healthcare organization has met the requirements outlines in the HITRUST Cybersecurity Framework (CSF). This eBook outlines how to review your vendor's HITRUST certification.

HITRUST certification, HITRUST, review of HITRUST, cybersecurity framework

No matter the vendor, there may be issues that arise at any point in the vendor relationship. In this podcast, learn examples of third-party risk management issues you may encounter and what to do next.

issue management, vendor issues, vendor issue management, third-party risk issues

Successful TPRM programs should involve key metrics that evaluate a vendor's health and stability. To help you better understand how to develop key metrics for your TPRM program, we've created this informative infographic.

key metrics, KPIs, third-party risk metrics, develop metrics

Natural disasters and cyberattacks are just two examples of business disrupting events that occur in the supply chain. This podcast outlines four examples of how TPRM can help you mitigate supply chain risk.

supply chain risk, mitigate supply chain risk, third-party risk management best practices

Whether you’re creating your program for the first time, or revising it, here are 8 best practices.

There's a lot to know to have a successful vendor risk management program. This infographic breaks down the what, why, who, and how to help.

risk management, involved in vendor management, third-party risk management, vendor risk management basics, beginner vendor management

What is vendor management and where to start, what you should know to mitigate risk, vendor lifecycle stages, who's responsible for what in a typical lifecycle and useful links and resources.

third-party risk management, to-do list, vendor management

In today's business climate, vendor financial health monitoring is extremely important. There are several factors to consider when reviewing vendor financial health, including inflation, political instability, and more.

vendor financial health, financials, vendor financials, financial importance

Vendor risks are always present. Although you can't eliminate the vendor's inherent risk you can lessen the likelihood by identifying and implementing controls. In this infographic, learn the process of inherent to residual vendor risk.

inherent vendor risk, residual vendor risk, inherent to residual risk process

Healthcare organizations must know how their vendors access, transmit, and store PHI and other sensitive data to remain compliant to protect their organization's and patient's data. Learn more in the eBook

hospital data, healthcare vendor management, healthcare organization, hospital risk management

Tasked with building a third-party risk management program from scratch? Developing and implementing a TPRM program requires considerable planning and coordination. This step-by-step guide will help you get started.

vendor management program, risk management program, TPRM program, third-party risk program

After conducting our State of Third-Party Risk Management Survey in November of 2022, we've analyzed the results and found six key highlights you should be aware. Listen to this podcast to find out what they are.

state of tprm, third-party risk management highlights, best practices, cybersecurity

It may be time to revisit your third-party risk management program. This eBook walks you through 12 ways you can start to improve your third-party risk management program.

program improvement, improve third-party risk management program, vendor management program improvement, improve vendor management

Most clinical studies are being conducted with the assistance of third-party vendors. Learn how clinical trial oversight remains a critical activity for sponsor organizations in this eBook.

healthcare vendor management, contract research organizations, CRO, clinical trial oversight

Even in today's remote working environment, you need to perform on-site vendor visits. In this podcast, we'll highlight 6 reasons on-site vendor visits are a valuable part of your due diligence practice.

vendor visits, on-site visit, vendor management, due diligence

A standardized and repeatable vendor risk assessment process is essential to protect your organization and customers from avoidable risks. In this eBook, we'll walk you through what you need to know for effective and efficient assessments.

risk assessment, vendor risk, risk assessment guide, vendor risk management

Identifying requirement and best practices for your industry, and following the TPRM lifecycle are great building blocks when implementing TPRM programs. Learn more in this guide.

vendor risk management, TPRM, vendor risk, essential guide, lifecycle, roles and responsibilities, program essentials

TPRM is a complex process that involves many rules, requirements, and processes all of which must be documented. This eBook will explain each of the governance documents and more.

vendor risk management, governance documents, vendor management policy, tprm documents, third-party risk governance documents

2022 was challenging for some organizations this year. In this podcast, learn six third-party risk management best practices to bring into 2023.

best practices, new year, vendor management, third-party risk

Contract research organizations (CROs) demonstrating strong vendor risk management programs can help sponsors feel their exposure to risk is well managed. In this eBook, learn the importance of sound vendor risk management for CROs.

CRO, contract research organization, outsourcing, clinical trial, risk exposure, due diligence, ongoing monitoring, third-party risk management program, vendor risk management, vendor risk

What does it mean for a healthcare organization to perform a risk assessment on a vendor? Is it a questionnaire, review, or process? Learn what a vendor risk assessment entails in this eBook.

healthcare, healthcare vendor management, risk assessment

In order to properly manage your vendors' associated risk, you need to thoroughly understand your organization’s vendor risk appetite statement. Use this infographic to help.

third-party risk management, vendor risk appetite, risk appetite statement, vendor risk

Third-party risk management involves many activities that can take up a lot of your team's time and resources. Listen to this podcast to learn 5 advantages of outsourcing TPRM tasks.

outsourcing vendor management, outsourcing tprm, outsourced vendors, third-party risk management tasks

The two most common reports, the SOC 1 and SOC 2, each assess a different scope of the vendor's controls and performance. In this infographic, you'll learn the difference between the two and which report you'll want to request.

vendor soc, soc reports, request soc report, SOC 1 report, SOC 2 report

A cybersecurity incident can have detrimental effects on your organization's financial health, reputation, and more. In this eBook, we'll cover why cybersecurity and business continuity are linked.

cyber risk, cybersecurity risk, vendor cyber risk, BCP, cybersecurity measures

Protecting your customers' sensitive information is important. In this podcast, learn ways to safeguard your organization from third-party cyber risk.

cybersecurity, vendor cybersecurity, cyber risk, cybersecurity risk

Establishing clear expectations with your vendor from the earliest stages of entering a relationship is important. There are two clauses that are essential, learn more about them in this infographic.

right to audit, cybersecurity, information security, data protection, data breaches, vendor management

You've completed your vendor risk assessment, performed due diligence, and have identified the inherent risk the vendor brings. This eBook highlights examples of ways your organization can improve the security of a vendor's system in your network.

mitigate risk, vendor risk, healthcare vendor risk, healthcare vendor management, third-party vendor risk, hipaa

Due diligence is a fundamental component of any third-party risk program. We will break down how to do vendor due diligence reviews on 6 of the most common reports we do.

ongoing monitoring, oversight, vendor management, due diligence

Venmonitor™ is a new software tool that brings the industry’s best risk intelligence data into one central location, allowing you to easily screen vendor or supplier performance across multiple risk domains.

venmonitor sample, risk intelligence data, risk domains, risk management, software

Critical vendor contract management is important. Learn 4 best practices in this podcast to ensure your monitoring your critical vendor contracts.

contract management, vendor contracts, critical vendor, podcast, critical vendor contracts

Many often ask "how many people should you dedicate to third-party risk management?" Even regulatory guidance offers little assistance in this area. Learn considerations, industry data, and more in the eBook.

vendor management, staffing, TPRM staffing

Use this checklist on specific common due diligence items you need to gather for based on if your vendor is classified as low, moderate or high risk.

due diligence checklist, high-risk vendor, checklist, vendor due diligence

Vendor risk management is a best practice, and, for many organizations, it's also a regulatory requirement. Dive deeper into the process of vendor risk management in this infographic.

vendor management process, vendor risk, risk management process,

Understanding what subservices (fourth parties) your vendors use is important. This infographic outlines how to review your subservice organizations within SOC reports.

subservice organizations, fourth-party vendor, reviewing SOC reports, vendor SOC report

Keeping the patient proactive care model in mind when considering TPRM is important. This podcast highlights 4 steps to take in creating a TPRM program for a health organization.

healthcare vendor management, proactive vendor management, third-party risk, health third-party risk

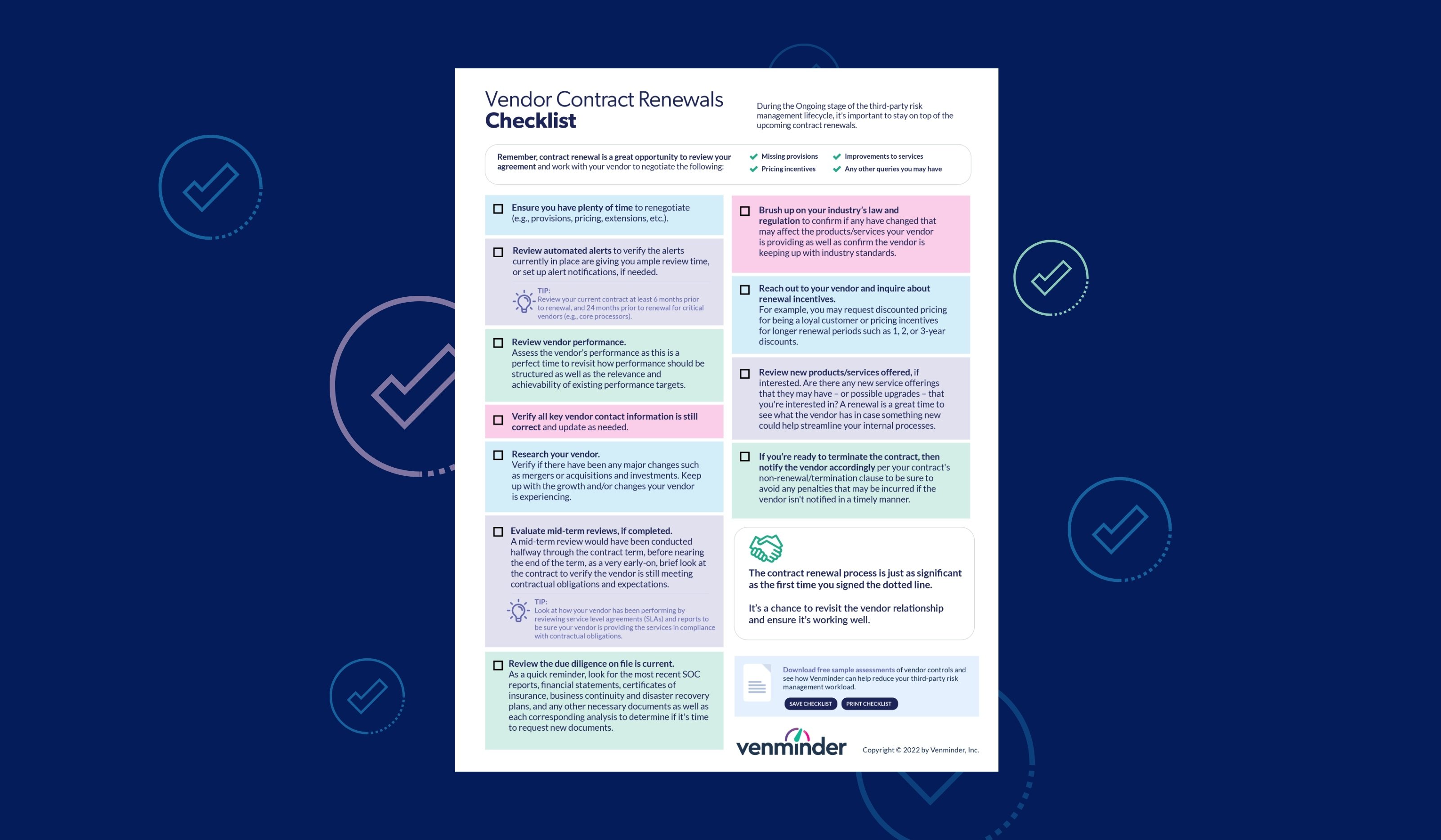

As a part of your ongoing monitoring, you need to stay on top of vendor contracts and renewal dates. Use this checklist to help.

contract management, vendor contracts, contract renewals, renewals

There is a lot to consider when incorporating CSR and ESG into current third-party risk management workflows and processes – including updates to your policy, risk assessments, due diligence, contracts, questionnaires and more.

third-party risk management, corporate social responsibility, environmental, social and governance, vendor management, toolkit

When managing vendor risk, many mistakenly consider critical and high risk synonymous, but they are not. There's an important difference between these terms and how they should be applied. Learn more in this infographic.

risk ratings, vendor criticality, high-risk vendor, vendor risk

There is still limited legislation on mandatory ESG disclosures, but regulators are continuing to address issues like climate change and modern slavery. Listen to this podcast to learn 3 ways to prepare your vendors.

esg disclosures, vendor esg, environmental, social and governance, regulations, disclosures

Ensure your organizations can balance the risks and rewards of the cloud by identifying the potential risks and thoroughly vetting your cloud service providers to make sure they meet your requirements.

cloud vendor, cloud service provider, cloud supplier, vendor management, considerations for cloud vendors

Use this handy checklist when thinking through the due diligence items you should be performing on your third parties.

vendor management, vendor risk management, check the box, document collection

Knowing how to conduct your vendor due diligence processes is only part of the equation. The real challenge for some organizations is understanding how to interpret and act on due diligence results. Learn how in this eBook.

vendor due diligence, due diligence collection, due diligence results, conducting vendor due diligence

No single financial statement will provide a full picture of a vendor's financial health. There are three statements that should be analyzed together to better understand financial risks posed.

financial statements, vendor financial health, financial performance, vendor financial statements

Measuring a vendor's performance is a necessary process that ensures the engagement continues to be beneficial. Also, helps protect your organization's reputation and ensures any issues are identified and addressed quickly.

measure vendor performance, vendor performance management, ways to measure, performance management

Has one of your critical healthcare vendors experienced a data breach? You can prepare now and anticipate you response to minimize damage, especially if that damage may involve your PHI or patient care.

patient care, healthcare data breach, healthcare organization, healthcare vendor management, vendor risk, cybersecurity

Having an exit strategy in case your vendor relationship must come to an end is crucial. Learn 4 exit strategies in this informational podcast.

vendor exit strategies, exit strategy, vendor management, contract management, terminate vendor

Knowing the risk your vendor brings to your organization is crucial. But, do you know and understand the risk categories or types to be reviewing and monitoring? Take the quiz to test how much you know!

quiz, risk categories, vendor management risk, vendor risk, third-party risk quiz

The healthcare industry practices proactive care, this same concept can be done for managing its third-party risks. Learn the importance for proactive vendor risk management in healthcare in this infographic.

healthcare, proactive care, proactive vendor risk management, vendor management, vendor risk, hipaa

Outsourcing a product or service to a vendor is a standard business strategy that can provide many benefits. Ensure you know these 6 vendor risk categories and common red flags.

red flags, outsourcing, risk categories, vendor management categories, vendor risk

The SEC released their 2022 Examination Priorities. Download this whitepaper to ensure your organization has your TPRM program in order.

exam preparation, vendor management exams, exam priorities, third-party risk management exam, cybersecurity, reports

Give yourself the ability to more successfully sidestep the aftermath of potentially disastrous scenarios by analyzing your vendor's business continuity and disaster recovery plans.

ongoing monitoring, disaster recover planning, business continuity planning, business planning, risk management

Vendor financial health includes many factors that your organization should be cognizant of and review accordingly. This podcast highlights three mistakes to avoid when reviewing.

vendor financial health, financial stability, financial reviews, vendor performance

The Standard Information Gathering (SIG) Lite questionnaire is a standardized questionnaire developed by Shared Assessments and used by organizations to provide information surrounding their control environment. Download a free SIG Lite assessment today.

sig lite, sig assessment, sig lite sample, free sig lite assessment

Vendor relationships can end for many reasons. Your organization's needs may have shifted and you're looking for a different vendor that better aligns with your goals. Whatever the reason for ending the relationship, you want to ensure you have an established offboarding process that minimizes issues.

offboarding, toolkit, comprehensive eBook, interactive checklist, vendor relationship management , exit strategy, termination

There is a beginning and end to every third-party relationship. In this podcast, you'll learn the stages of third-party risk management lifecycle.

lifecycle stages, onboarding, offboarding, ongoing activities, podcast

Learn the steps of the third-party risk management lifecycle to protect your organization from vendor risks using this toolkit.

third-party risk management lifecycle interactive toolkit PowerPoint Template Printable 1-Page PDF due diligence, contract management, risk assessment, scoping

When your organization is exposed to a variety of vendor risks, it doesn't hurt to have the extra layer of protection that vendor site visits provide. Use this handy checklist and infographic to ensure your organization understands the importance of site visits.

checklist, on-site visit, virtual vendor visit, vendor risk

Not sure where to include in your vendor contracts? This eBook outlines sample contract language and recommended tips to help with contract creation.

contract management, vendor management, contract compliance, contract clauses

Use this checklist of things to help you manage and be sure you’re prepared when you have an upcoming audit or regulatory exam.

checklist, auditors, vendor management exam, vendor management audit

Although you don't have direct contact with your fourth parties, it's essential to understand how your third-party vendors manage their risk. Use this helpful infographic when discussing fourth-party due diligence with your vendors.

vendor relationship, vendor risk, vendor management, fourth-party risk

Successful vendor risk management requires the teamwork of stakeholders across the organization, and vendor managers play a crucial role. This eBook will help you engage, educate and enable your vendor managers.

vendor manager education, manager training, vendor manager tips, vendor management

Mitigating vendor risk is an important component of your vendor management program to ensure that your overall business operations can continue on. Listen to this podcast to learn how to mitigate vendor risk.

mitigate third-party risk, third-party risk mitigation, vendor risk management

Your third-party risk management program document lays out the concepts within the policy. Download this checklist to assist in creating an effective and mature third-party risk management document.

governance documentation, vendor management program document, policy documents, documentation

Your critical vendors provide products or services that your organization is highly dependent on. Learn the questions you can ask to determine if a vendor is critical or non-critical in this infographic.

high-risk vendor, vendor management, vendor risk, third-party vendor

Third-party risk management in practice is a complex ecosystem of processes, tasks, timing and risk mitigation. Various responsibilities and requirements are distributed across a range of accountable stakeholders. Download this toolkit for helpful templates and charts.

vendor management, vendor oversight, stakeholders, roles and responsibilities

Our annual State of Third-Party Risk Management survey highlighted four areas that are top concern for third-party risk management professionals this year. Listen on to learn them.

ESG, emerging risks, vendor management, due diligence

You should partner with a vendor who meets your organization’s expectations. Download this infographic for signs that it is time to end your vendor relationship.

vendor relationship, vendor management, third-party risk management, vendor profiling

Better understand when to start your due diligence, what to do if you can't get a document, why you need a good working relationship with your lines of business.

vendor management, third-party risk, document collection

All vendor relationships have inherent risks. If you choose to work with the vendor, you'll need different techniques to handle the risk. This infographic covers three risk handling techniques known as mitigation, transference and acceptance.

inherent risk, vendor relationship, vendor management

Third-party risk management is no exception, and as a practice, has steadily changed its tune over the past few decades. Explore the advances in third-party risk management in this infographic.

vendor management evolution, vendor lifecycle, industry change

2022 is going to be another year with a strong vendor management focus. Are you prepared? Listen to this podcast to learn 3 best practices to follow this year.

due diligence, vendor profiling, third-party risk management

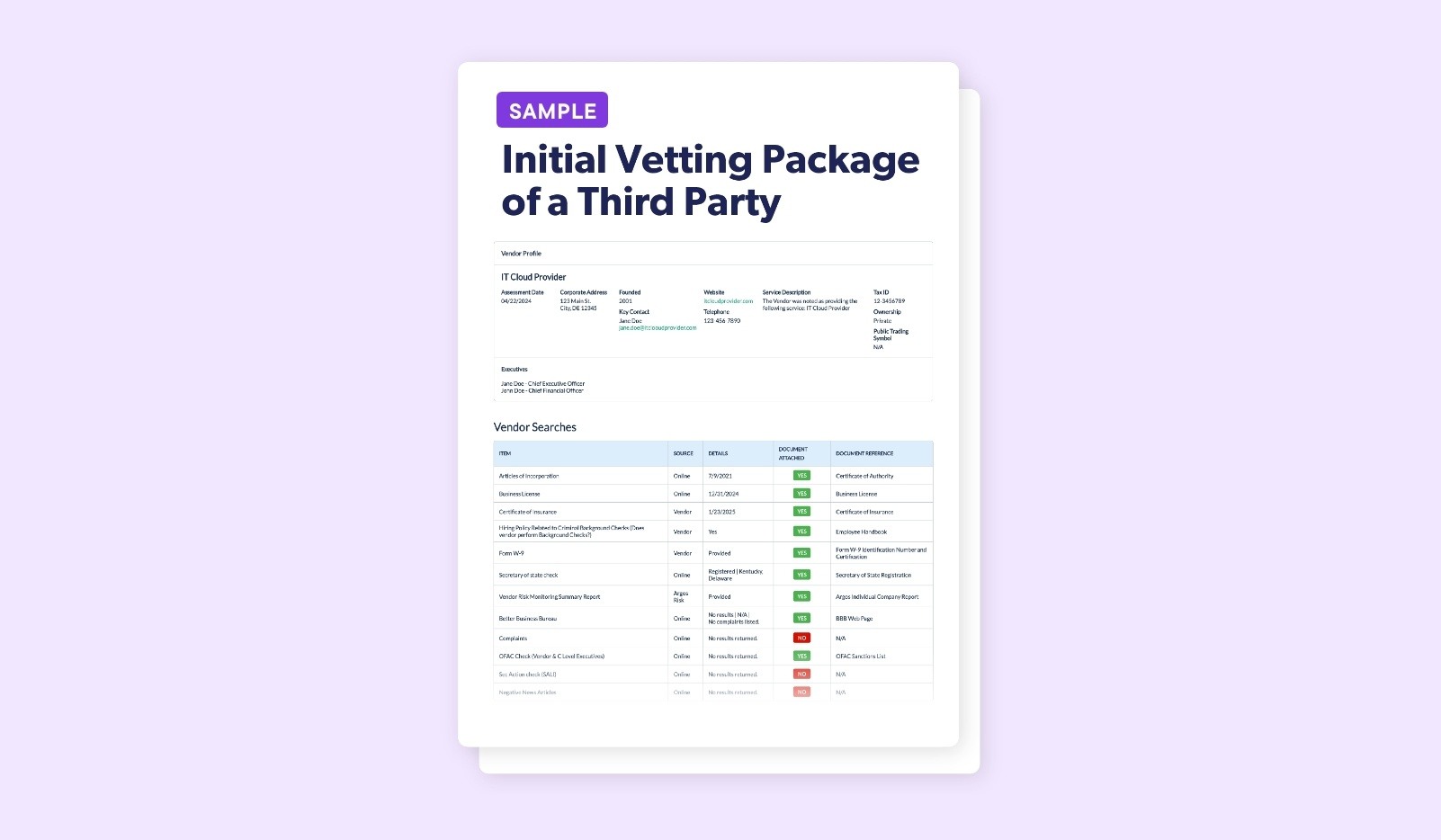

As part of your vendor due diligence process and regardless of risk level, there are 19 items your organization should be committing to file for every third-party involved with your business.

initial vendor vetting, due diligence, onboarding

Listen to this podcast that highlights three main third-party risk management lessons learned in 2021. Learn how your organization can use these lessons to prepare for 2022.

due diligence, tips, vendor management

To help guide you and your team in understanding some of the most common terms found in a SOC report.

cybersecurity, information security, data breach

Well-written contracts are the foundation of the relationship between your organization and your vendor. Download this infographic to learn 5 reasons you should renegotiate vendor contracts.

vendor contract management, addendum, vendor relationship

Not sure where to start when building a third-party risk management program? This podcast covers 4 essentials tips to building a TPRM program and what you should include.

vendor management, due diligence, vendor risk

Don't let your vendors scare you this Halloween. Discover risky vendor situations that should be laid to rest in the third-party risk management cemetery in this infographic.

vendor management, vendor behavior, critical vendor, third-party risk management

Your third parties should be ranked as critical or non-critical for business disruption. This infographic outlines 10 general items that are needed to be on file for critical vendors.

vendor management, vendor risk, critical vendor management, due diligence, due diligence items to review

This infographic breaks down four key areas to pay attention to regarding vendor cybersecurity that will help you prepare your organization.

cybersecurity areas, vendor risk, vendor management

This podcast will highlight what you should be reviewing in your third-parties incident response plans. Gain an understanding of how your vendor will respond to an incident when it happens.

vendor management, third-party risk, continuity planning, vendor risk

To help ensure you gather the information you need, use this handy checklist that covers what you need to review when analyzing your vendor’s cybersecurity.

data breach, information security, vendor cybersecurity checklist, cybersecurity checklist, checklist, vendor risk, cybersecurity risk

Michael Kossman, Chief Operating Officer and Chief Compliance Officer at Aspiriant, talks about the challenges of implementing a third-party risk program in asset management and the importance of third-party risk management.

third-party risk management program, due diligence, third-party risk challenges, vendor management

Timing is everything to be successful in vendor contract management. Download this guide to help get the most value from your vendor contracts during renewal time.

contract management, vendor management, contract guide

Clearly communicating setting expectations with your third party is essential for building a healthy and productive relationship. Download this playbook designed to support third-party risk management teams.

vendor relationships, prospective clients, communication, playbook for vendor managers

In this podcast, understand what a vendor confidentiality agreement is and how to create and review an agreement. Also, learn why these agreements are important in a third-party risk management strategy.

vendor risk, vendor management, NDA

Contract management is a key component in managing risk and vendor relationships. Our eBook is your tool to master vendor contract management.

contracts, third-party risk management, vendor contracts

Performing risk assessments may seem daunting, but are a worthwhile investment. Download this infographic to learn the tried-and-true steps to complete a vendor risk assessment.

vendor risk assessment, risk assessment, how-to, TPRM, vendor risk, risk management, vendor risk management, assessments, third-party risk

Vendor contracts work both as a roadmap to guide you through the business relationship and as a safety net. Download this eBook to learn what to include in critical vendor contracts.

critical vendors, critical vendor management, vendor contract management, vendor management

Understand how to get from inherent vendor risk to residual risk in this podcast. Learn the basics to calculate these risks.

vendor risk management, risk rating, calculating risk

Learn how to maximize value, cost, quality, day-to-day advantages and more. Download this infographic to understand the strategic advantages of doing TPRM.

Third-party risk management, cost advantage, quality advantage, maximize benefits, vendor management

Well-written business continuity and disaster recovery plans are important. Ensure your critical vendors are accounted for in your plans. Download the infographic to learn how.

third-party risk management, critical vendor management, continuity planning

Organizations are feeling the strain of keeping data and systems safe. Download this eBook to understand how TPRM and InfoSec teams can collaborate.

data, third-party vendors, relationship building, collaboration

Listen to this podcast to understand the various types of vendor business continuity and disaster recovery testing.

third-party risk management, testing, bc/dr testing, vendor management

Many of the OCIE's priorities changed as new risks emerged and existing risks were mitigated or heightened. Download the whitepaper to ensure you have your third-party risk management in order.

cybersecurity, vendor risk, third-party risk management, vendor management, ocie priorities

This eBook will guide you through creating an effective vendor risk assessment questionnaire of your own for proper third-party risk management.

vendor risk management, third-party risk management, questionnaires, assessments

Learn examples of fourth-party related clauses and how to write these requirements into your vendor contracts.

third-party risk management, due diligence, contract management, fourth parties, requirements

Realizing the value of third-party risk management as a strategic enabler requires you to look beyond the routine check-the-box requirements. Download the eBook to get an understanding on how TPRM can enable your organization's strategies.

vendor management, third-party risk management lifecycle, strategic enabler, regulatory compliance, organization strategy

Learn the most common myths of third-party risk management and learn the truth about the misconceptions in this infographic.

due diligence, vendor management, vendor risk

Understand the basis of vendor compliance risk and how to protect your organization from it in this podcast.

third-party risk management, risk assessment, risk category, due diligence

Download the infographic to learn the next steps to take that enhance your organizations internal processes and procedures.

financial risk, financial assessment

Understand the three core practices of third-party risk management in this podcast.

third-party risk management, vendor management, due diligence

It's essential to understand the risks posed in third-party relationships. Download this eBook to learn about the different types of vendor risk and how they can impact your operations.

due diligence, risk assessment, vendor risk, vendor management, financial risk, reputational risk, operational risk

Vendor financials are an important topic. Understand what documents are acceptable to ask for from privately held vendors in this podcast.

third-party risk management, vendor management, due diligence, document collection

Listen to this 90 second podcast to learn the three best practices for overseeing international vendors.

third-party risk management, risk assessment, risk category, due diligence, best practices, international vendors

Download this eBook to understand the importance of your vendor's financial health, especially your critical vendors and how they can affect your organizations reputation.

due diligence, risk assessment, vendor selection, financials

This extensive flight path assists with mastering third-party risk management. Successfully navigate through these third-party risk terminals to help your organization, your customers and your key stakeholders remain safe on the third-party risk trip.

due diligence, risk assessment, vendor selection

There are vendor management best practices you should be aware of to help avoid being deceived by a vendor. Listen to this podcast to quickly learn three tips to help you with the process.

vendor oversight, due diligence

This in-depth guide will walk you through the process of collecting due diligence and solutions for related common hurdles.

ongoing monitoring, oversight monitoring

Spring is the perfect time to dust off your vendor management program and clean up your processes with these tips.

vendor management, due diligence, policy

Play this interactive game and read the quick guide to learn why these 5 pitfalls of vendor risk come into play and what to do.

due diligence, vendor issues, third-party risk management, vendor risk

Listen to this 90-second podcast to hear more about the differences between questionnaires and assessments and why your organization needs both.

vendor assessments

Listen to this 90-second podcast to hear vendor due diligence fast facts you need to know to be successful.

due diligence

Listen to this 90-second podcast to hear more about how you can successfully offboard one of your vendors.

offboarding

This infographic will breakdown what you need to be looking for in your vendor's pandemic plan to keep your employees and customers safe.

business continuity, disaster recovery, pandemic planning, due diligence

Use this guide when developing, managing mature vendor management governance documentation.

ongoing monitoring

Listen to this week's podcast to help you create your third-party risk management procedures to be more successful.

Find out what you need to know about the process and the key points of ongoing vendor due diligence that you should be aware of in this 90-second podcast.

ongoing monitoring, oversight management

Learn 6 best practices you need to do when measuring, assessing and planning vendor management processes in the new year.

Are you selecting a core processing vendor? Listen to this 90-second podcast to learn about the factors you need to keep top of mind.

vendor vetting

Reputation vendor risk is every bit as important as other categories of risk, but it can be harder to gauge. This eBook will help you navigate it.

ongoing monitoring

New to third-party risk management? Understand what vendor management is and why it's important with this 90-second podcast.

vendor management, third-party risk management, best practices

View this interactive guide for how to review your vendor’s SOC reports by walking you through each section and the important areas to pay attention to.

cybersecurity

Find out what important lessons you need to be aware of going into the new year, so you can be more successful in vendor management.

vendor management

This podcast covers a few of the items that you should tackle before the end of the year to be better prepared for 2021.

vendor management

With the holiday season upon us, it’s time to determine if your vendors made the nice list! To help you, we’ve put together this checklist with what to consider.

vendor checklist, determine vendors, vendor due diligence

Whether you are new to vendor risk assessments, or want to improve your current approach, this video walks you through how to manage the process successfully.

risk assessment, risk rating

This video breaks down the basics of what vendor financial health is and why you should be including this step in your organization’s due diligence process.

oversight monitoring, ongoing monitoring

Listen to this podcast to help you figure out the best way to gather vendor management resources.

vendor management

Proper cybersecurity has never been more important than it is today. Use the six best practices covered in this video to help ensure your vendor can prevent, detect and respond to a cybersecurity issue.

data breach, information security

If you don’t have an adequate plan to properly manage your vendor’s risk, then your organization could be another scary statistic. Learn how to stay safe.

data breach, information security, data breach statistics

Listen to this week’s podcast for the top three benefits and ROI you can achieve by investing in third-party risk management.

vendor management

You can take proactive steps that will help you better protect your customers and reputation from a third-party data breach. Listen to this 90-second podcast for our top five tips.

data breach, cybersecurity, information security

To help fintechs win points with your clients, use this infographic that covers what you need to know about the changing vendor management expectations.

third-party risk management

In this podcast, learn the top four tips that will help fintech organizations more successfully meet their client and regulator expectations.

regulatory compliance

Learn about the importance of strong vendor information security and three best practices our experts recommend in this podcast.

data breach, cybersecurity

You can take specific steps that will help you maximize even the smallest budget for vendor management. Listen to this week’s podcast for the top three tips we recommend to help you make the most of your organization’s budget.

Use this quick, but comprehensive, guide to help mitigate fourth-party risk.

If you have well-developed vendor contracts, then you're setting your organization up for success when it comes to vendor oversight. Find out the top three reasons why your vendor contracts directly affect your level of oversight.

due diligence, contract management, ongoing monitoring