VENDILIGENCE™

Disaster Recovery and Business Continuity Risk Assessment

Our Business Continuity & Disaster Recovery Assessment (BCA) dives into your vendor's business continuity and disaster recovery readiness, checking whether disruptions in their operations could ripple into your business workflow. With a team of experienced professionals, Venminder assesses your vendor's strategic measures to face unforeseen events, providing a high-level and detailed view of potential risks. This business continuity assessment reviews recovery plans and data backup so you can proactively identify potential gaps and take the necessary countermeasures.

PRODUCT TOUR

See it in Action: Take a tour of the Point-in-Time Cybersecurity Assessment now

Outsourcing this crucial review to Venminder means obtaining a clear picture of your vendor's or supplier's cybersecurity readiness level, helping you to identify areas of strength and weakness, ensuring secure and robust relationships.

Most Commonly Used For:

Technology Suppliers, Data-Handling Vendors, and SaaS Providers

Venminder is trusted by over 1,200 companies worldwide

Pinpoints areas where vendors or suppliers may not be prepared for the unexpected

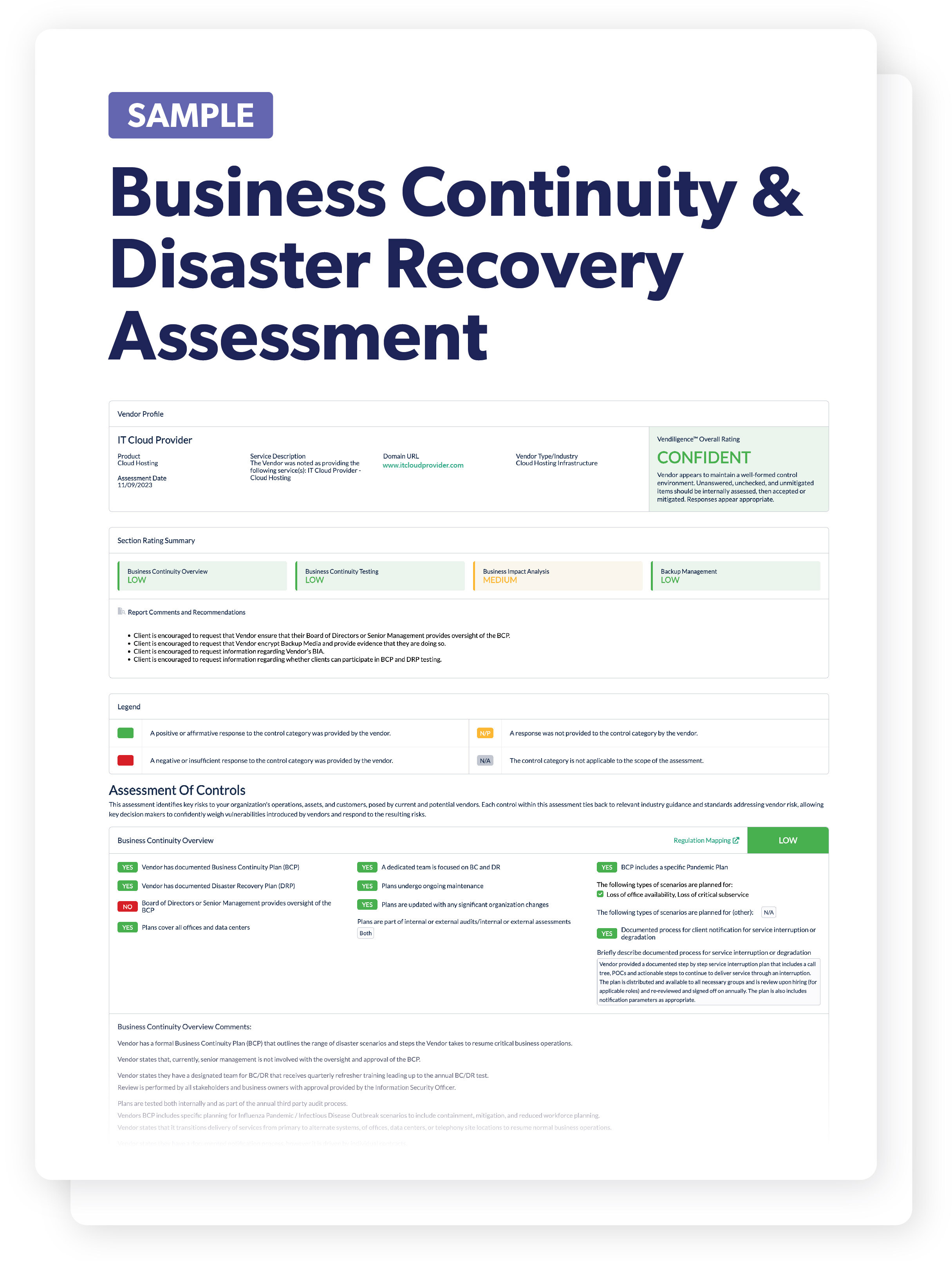

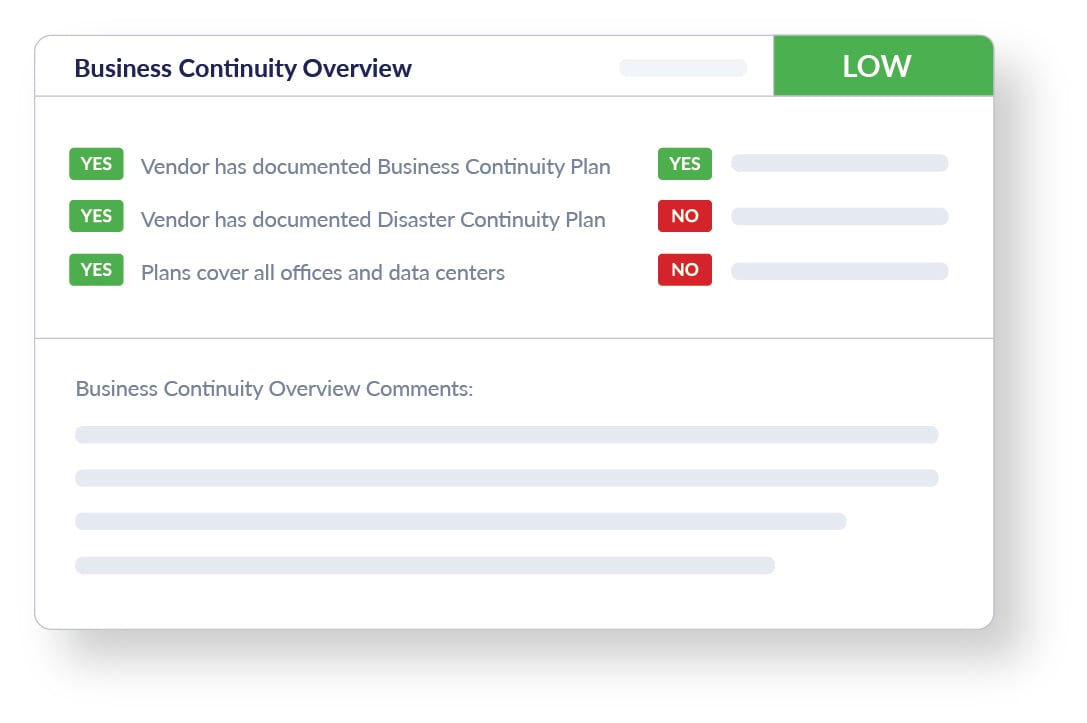

Business Continuity Overview

We provide an insightful review of your vendor's documented Business Continuity and Disaster Recovery Plans. This overview examines your vendor's managerial oversight, whether there is a dedicated continuity team, and plan scope. It also determines their readiness for pandemic preparedness and a summary of their process for service interruption or degradation, offering a valuable view of whether they are setup to ensure uninterrupted operations amid unforeseen events.

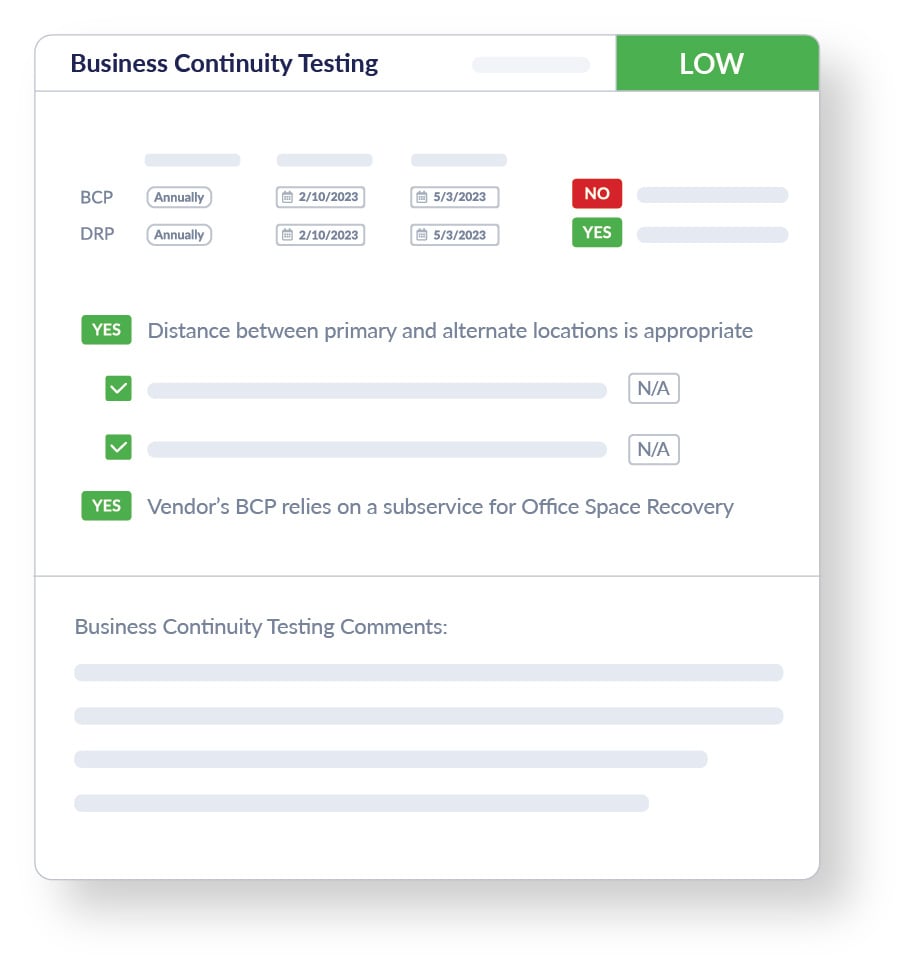

Business Continuity Testing

We evaluate your vendor's approach to testing their Business Continuity and Disaster Recovery plans. We provide the frequency of their tests and the robustness of alternative arrangements like remote work capabilities and secondary data centers. Our expert scoring system reflects the effectiveness and comprehensiveness of a vendor’s testing, helping to provide a clearer understanding of their readiness during real-world disruptions.

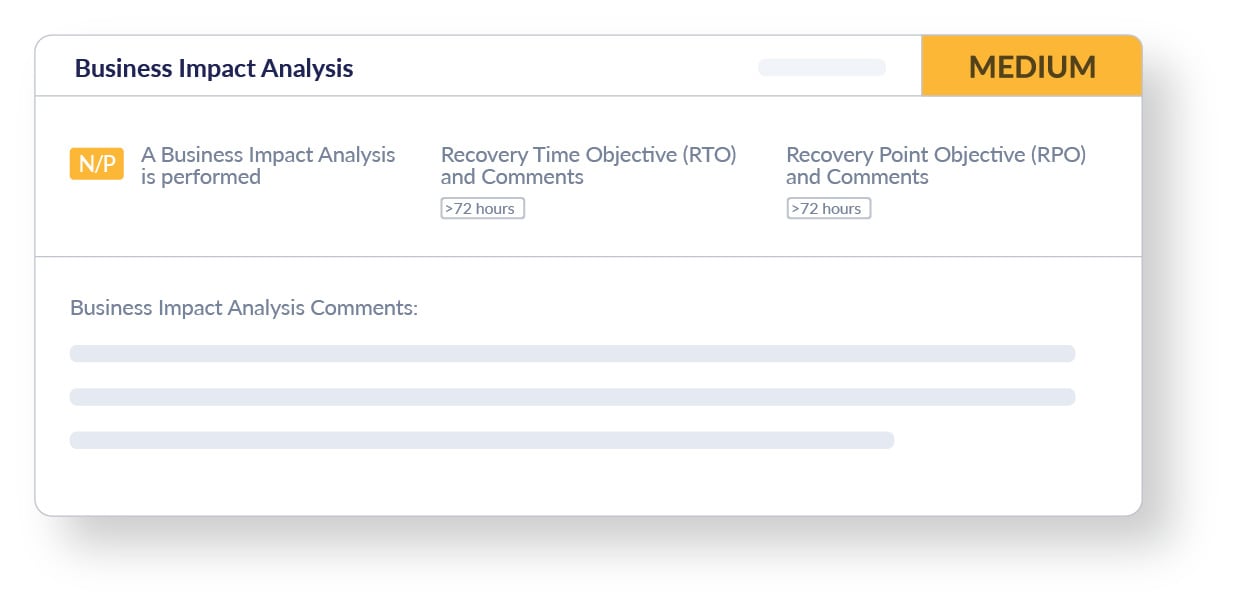

Business Impact Analysis

We evaluate your vendor's process of analyzing the operational impacts arising from various interruption scenarios. This domain zeroes in on their Recovery Time Objectives (RTO) and Recovery Point Objectives (RPO), assessing how well they meet these objectives. Our analysis illuminates the resilience of their operational frameworks in facing adversities, facilitating a better understanding of potential risk and preparedness.

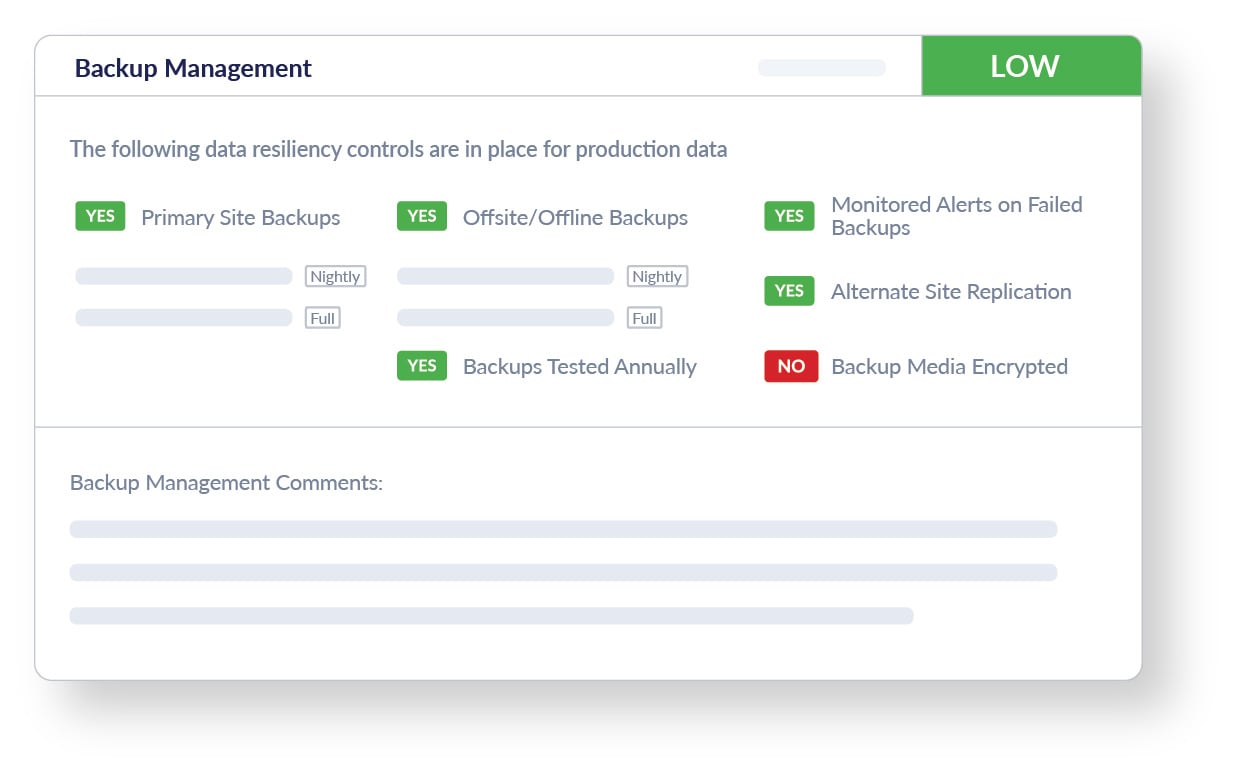

Backup Management

We review your vendor's data resiliency measures with a keen focus on backup protocols for both primary and alternate sites. This risk-domain explores backup frequency, offsite/offline backup procedures, and the testing of these backups. Our scoring reflects the effectiveness of their data resiliency strategies and alert systems for backup failures, ensuring you understand how your vendor is safeguarding your crucial data.

Gain a valuable lens into the overall robustness and resilience of your vendor's or supplier’s technological infrastructure and processes

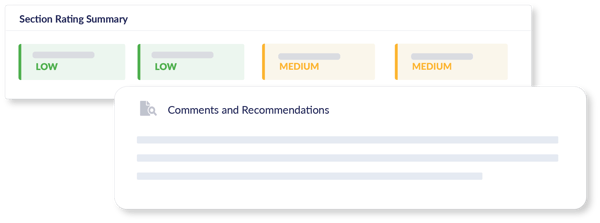

Expert Risk Ratings

Both overarching and focused risk ratings grant a layered understanding, enabling you to make decisions faster. Our assessment dives into processes your vendor has in place for business continuity testing, their business impact analysis, and backup management.

Actionable Comments and Recommendations

Our assessment provides a written summary of findings within each risk domain, as well as overall findings and any recommendations. Driven by the responses and our review, these comments offer targeted insights, making it easier for you to act on the data and make well-informed risk-based decisions.

VENDILIGENCE™

Disaster Recovery and Business Continuity Risk Assessment

Our Business Continuity and Disaster Recovery Assessment (BCA) dives into your vendor's business continuity and disaster recovery readiness, checking whether disruptions in their operations could ripple into your business workflow. With a team of experienced professionals, Venminder assesses your vendor's strategic measures to face unforeseen events, providing a high-level and detailed view of potential risks. This business continuity assessment reviews recovery plans and data backup so you can proactively identify potential gaps and take the necessary countermeasures.

Leverage Expertise and Save Valuable Time

The task of pursuing vendors for essential documentation to validate business continuity plans can be a daunting and time-consuming endeavor. The challenge amplifies when the documents in question require a specialized level of expertise for review. The continual screening of vendors' continuity and recovery strategies, particularly when engaging with multiple third-party vendors, compounds the intricacy of the task at hand.

With Venminder, you can offload the cumbersome task of sifting through mass amounts of documentation on your vendor’s continuity and recovery strategies. Our seasoned team and advanced solutions provide a much-needed expert review and evaluation of your vendor’s processes. Our business continuity plan risk assessment frees up your team in order to accelerate the decision-making process, enabling a swifter screening and evaluation of vendors. In addition, our Flexible Spend Account and additional services ensure that your team can continually focus on crucial strategic directions, all while staying compliant with regulations requiring a thorough look at business continuity plans. By leveraging our expertise, you regain the time, focus, and resources to propel your operational objectives forward.

Standardized Assessment, Simplified Comparisons

Establishing a consistent review method for your vendors can be a challenging undertaking, especially in a landscape where regulatory bodies frequently introduce new requirements. Ensuring that your review processes align with both regulatory and industry standards further compounds the complexity. The assessment of your vendor’s continuity and recovery strategies is an added demand, which becomes even more intricate when dealing with multiple third-party vendors. The continuous cycle of review and continued due diligence demands a structured yet flexible approach to ensure compliance and operational resilience.

Venminder's structured approach streamlines vendor risk assessments, ensuring consistency at scale. Our standardized set of questions aligns with regulatory and industry standards, facilitating easy comparisons between vendors. Beyond a checklist, we delve into key areas of your vendor's business continuity practices. Our Control Assessments, available to order when needed and viewable directly on the Venminder platform, culminate in a risk heatmap view, simplifying cross-vendor comparisons at a glance. This powerful heatmap gives you clear insights into vendor preparedness, aiding in effortless navigation through regulatory requirements while keeping a pulse on vendor resilience at scale.

How it works

STEP 1

Alleviate the burden of chasing for business continuity & disaster recovery plans

Venminder’s team directly works with your vendor or supplier to collect the numerous technical documents needed for a qualified and comprehensive assessment of their business continuity and disaster recovery prepardness.

STEP 2

Assessed by experienced professionals

Venminder’s experienced professionals thoroughly review the evidence to assess whether your vendor or supplier has implemented the industry standard and regulatory requirement processes that should be in place to avoid disruptions that could ripple into your business workflow.

STEP 3

Streamlined Business Continuity Prepardness Evaluations

You receive an easy-to-understand risk assessment on your vendor or supplier's business continuity and disaster recovery prepardness that is available on the Venminder platform and as a downloadable PDF, our reports are easy to understand and are perfect for internal sharing, review, and decision-making.

STEP 4

Improve risk-based decisions with the right insights

You and your organization’s decision-makers can now make an informed choice about any risks presented by the vendor or supplier and whether you need to take action in addressing potential gaps and take the necessary countermeasures.

Discover why Venminder

is top-rated by customers

Know if vendors and suppliers are in compliance with

industry guidelines, frameworks, standards and laws

Technology Standards and Frameworks

AICPA Trust Services Criteria

ISO/IEC 27001:2022

NIST Framework for Improving Critical Infrastructure Cybersecurity version 1.1

NIST SP 800-53 Rev. 5 Security and Privacy Controls for Information Systems and Organizations

NIST SP 800-63b Digital Identity Guidelines

Regulations, Statutes, and Laws

California Consumer Privacy Act

California Privacy Rights Act

Canadian Personal Information Protection and Electronic Documents Act

China Personal Information Protection Law

Colorado Privacy Act

Connecticut Data Privacy Act

EU General Data Protection Regulation

Health Insurance Portability and Accountability Act

Interagency Guidelines Establishing Information Security Standards

Interagency Guidance on Third-Party Relationships

New York Department of Financial Services - 23 NYCRR 500

Industry Guidance

Center for Internet Security – Critical Security Controls v8

FFIEC IT Examination Handbook – Audit Booklet

FFIEC IT Examination Handbook – Business Continuity Booklet

FFIEC IT Examination Handbook – Management Booklet

FFIEC IT Examination Handbook – Operations Booklet

FFIEC IT Examination Handbook – Outsourcing Technology Services

FFIEC IT Examination Handbook - Wholesale Payment Systems Booklet

FINRA Report on Cybersecurity Practices

OCC 2021-36 Authentication and Access to Financial Institution Services and Systems

SEC Regulation SCI reference to NIST 800-53 Rev. 4

Learn about the regulations, standards, guidelines, and laws, that our Business Continuity and Disaster Recovery Assessment maps to here >

You won't just hear it from us

Free Sample

Business Continuity & Disaster Recovery Assessment

Get a sample copy of this business continuity risk assessment to see how Venminder can reduce your work and help you identify potential gaps at your vendor before they disrupt your business or your customers.

Free Resources

Ensure Your Third Parties can continue to Support you when faced with the Unexpected

Explore Venminder

Continuous Monitoring

Software Platform

Why Choose Venminder

Continue your Education

.gif?width=1920&name=Sample-Graphic-Animation%20(1).gif)