VENDILIGENCE™ CONTROL ASSESSMENTS

Human-Powered Vendor Due Diligence Services and Control Assessments

Venminder is trusted by over 1,200 companies worldwide

MORE THAN JUST SOFTWARE

We combine the human touch with technology to create a smarter, faster vendor due diligence solution

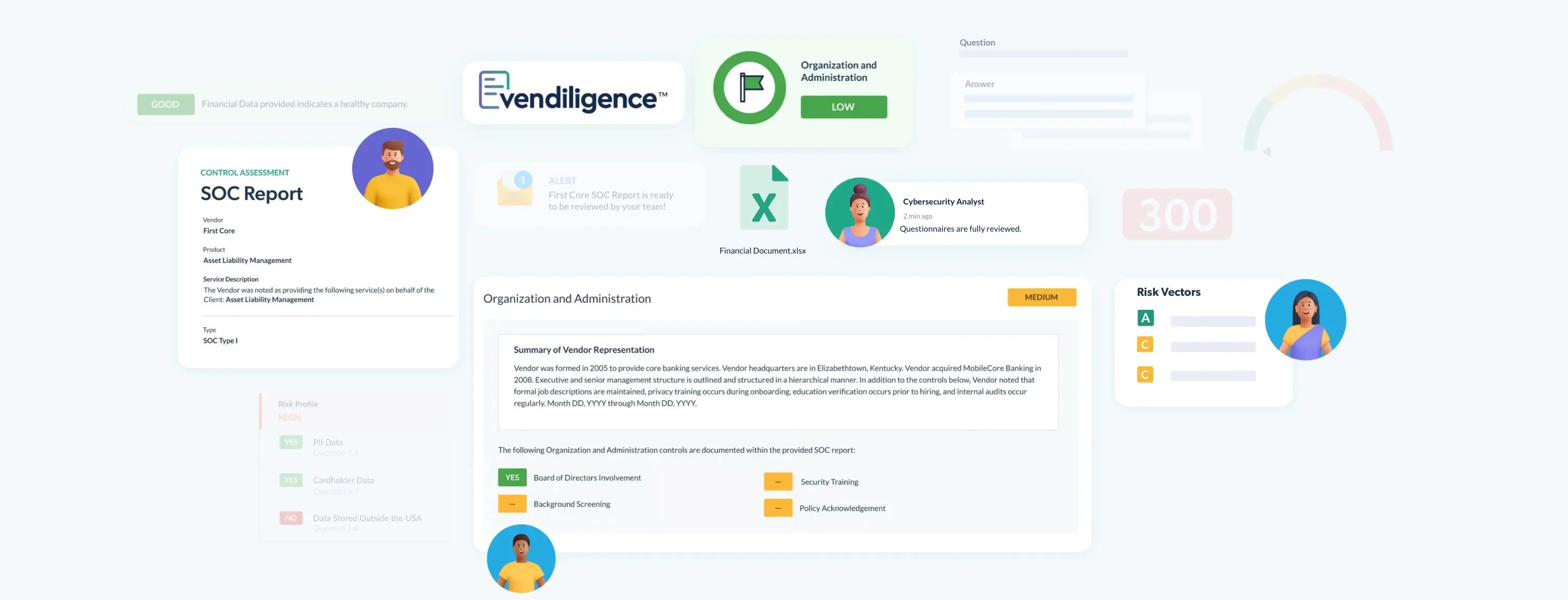

Get completed risk assessments on your vendor's controls from qualified experts

Our experts review all documentation and questionnaires provided by the vendor and you get a report for each control you wanted assessed with risk ratings, indicators, and recommendations.

It's a cost effective approach that saves you time and resources

Your team gets to focus on the importance strategic decisions at hand. With Venminder's "a la carte" approach and ability to pre-purchase flexible buckets of spend, you get to control what assessments you purchase when you need them.

Have trust in the capabilities of those reviewing your vendor's controls

Our teams holds a range of certifications and qualifications including: CISSP, Paralegal, CPA, CRISC, GCIH, ABCP, CCNA, and more.

FASTER DUE DILIGENCE = FASTER DECISIONS

Speed up your baseline vendor due diligence

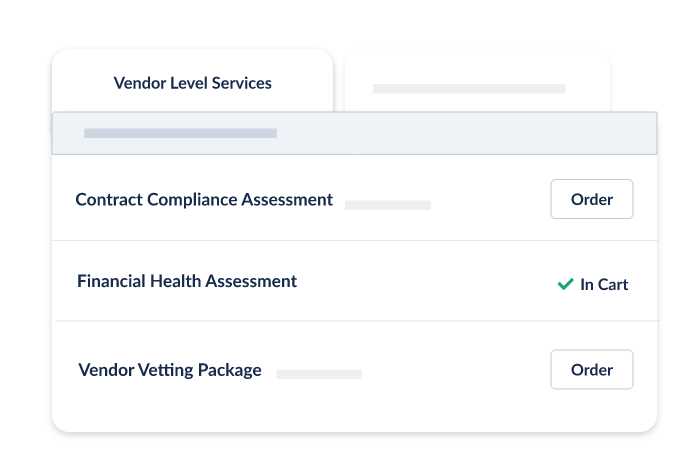

Contract Compliance Assessment

Have confidence your contracts are in compliance.

Initial Vetting Package of a Third-Party

Know if key information is accurate and current on your vendors.

Financial Health Assessment

Gain insight into your vendor's overall financial health and viability.

TECHNOLOGY VENDOR MUST HAVES

Know that your vendors are appropriately protecting your data

OPERATIONAL RISKS INSIGHTS

See if your vendors are setup to operate day-to-day business activities

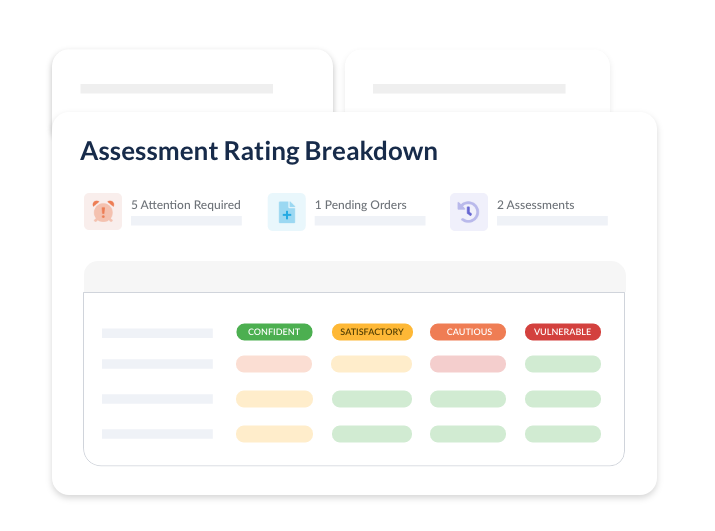

VISUAL DASHBOARDS

Understand your vendor performance

in a centralized location

See how your vendors are performing across different controls

Vendiligence™ tabs appears on both Ongoing and Onboarding workspaces to display insight into control assessment history and grant ability to place new orders.

Request a Demo

Visualize trends and ratings in real time

Understand whether your vendor has continuity plans in place — and whether those plans have been properly tested, with clear Recovery Time and Recovery Point Objectives.

With our vendor due diligence software, you can easily review your vendor’s control assessment history, track their business continuity preparedness, and place new assessment orders directly from the Ongoing and Onboarding workspaces.

Easily order new control assessments

With vendor risk assessment tool, you can order a vendor or product specific control assessments directly from the dashboard.

Request a Demo

You won't just hear it from us

Continuous Monitoring

Software Platform

Why Choose Venminder

Continue your Education

.gif?width=1920&name=Sample-Graphic-Animation%20(1).gif)